A Certificate of Insurance (COI, for short) is a one-page document that shows you’re insured. It’s basically a snapshot of your coverage you can send to anyone who needs to verify it.

One Mighty Certificate, Many Names

A Certificate of Insurance is also called:

- ACORD form

- ACORD certificate

- Proof of insurance

- Business insurance certificate

- Certificate of liability insurance

- Plus other variations!

Why Does a Business Certificate of Insurance Matter?

You’re a savvy solopreneur, which is why you carry small business insurance. It protects your hard work — all the long nights, the extra hustle — from costly claims that can undo what you’ve built.

But how can clients, event organizers, and partnering businesses be certain you’re safe to work with?

Enter your COI. It’s proof you have active business coverage and take your work seriously.

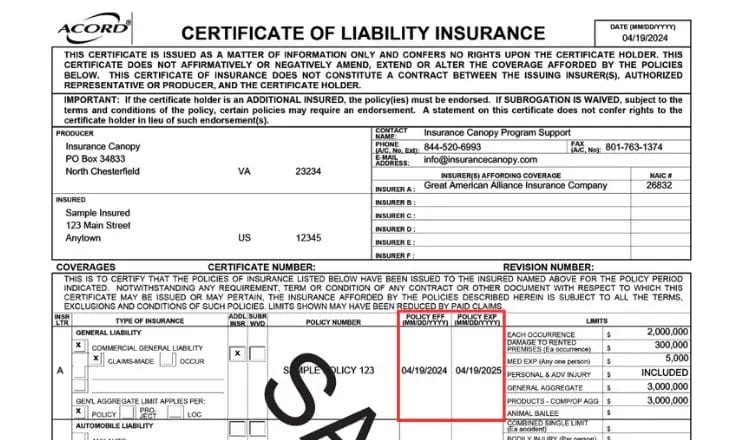

So, What’s in a Certificate of Insurance for Liability?

Read your COI like a pro. Here’s what’s on it:

- Your policy number

- Your name or business name (“insured”)

- The insurance company (“producer”)

- Your coverage types (i.e., general liability insurance)

- Start and end dates (“policy eff.” and “policy exp.”)

- Coverage limits (how much you’re covered for)

- Any additional insureds (like an event organizer)

It’s common for a person or business requesting a copy of your COI to ask that you add them as an additional insured on your policy. When you do this, your coverage extends to them in case something goes wrong, and both of you are blamed for the situation.

Remember: Your COI is not the insurance policy itself — it’s the TL;DR of your coverage. It’s just meant to highlight the main elements of your insurance contract.

Quick Tip: Before downloading and sending your Certificate of Insurance to someone, double-check that your info is correct — and that theirs is, too, if they need to be listed as an additional insured.

Certificate of Insurance Example

Who Commonly Asks for a Certificate of Liability Insurance?

Anyone who could be affected by your work might ask for your Certificate of Insurance for business. This includes:

- Clients

- Venues

- Event organizers

- Property managers

- Landlords

Showing proof of insurance is often part of contract requirements. It’s a normal industry ask and nothing to be afraid of! In fact, it’s a good sign the party you’re working with cares as much as you do about doing things right.

Examples by Industry

Freelance Photographer: A high-end wedding venue won’t confirm your contract until they get your COI. They want assurance that if someone trips over your tripod, you have insurance to take care of the accident.

Fitness Professional: You score a group class gig at the local gym, but before you can be added to the schedule, you need to send the owner your COI. They’re looking for proof of at least $1 million in general liability coverage.

Farmers Market Vendor: You applied to vend at the hottest summer market and got accepted! The organizer requires your COI with the event listed as an additional insured so they can reserve your booth spot and put you in the official directory.

The bottom line is that doing business of any kind is risky. A COI shows you’re prepared to handle any “oh no” moments that may pop up while you work.

How to Get a Certificate of Insurance for a Small Business

If you’re an Insurance Canopy policyholder, getting your COI just takes a few clicks.

- Log in to your user dashboard

- Navigate to “Download Documents”

- Click on “Proof of Insurance” to download your COI

Need to add someone as an additional insured first? You can do that right from your dashboard. Once you download your COI, you can print it out or email it directly to anyone who needs it.

Phew! Now that you know the answer to What is a Certificate of Insurance?, you’re ready to get back to business. Go make your small business dreams a reality. We’ve got you covered.

Don’t have coverage yet? Insurance Canopy offers top-rated small business insurance (with an instant COI, of course) you can buy online in minutes!

Common Questions About Small Business Certificates of Insurance

Is It Normal for Clients to Want a Copy of My Insurance?

Yes, it is normal for clients to want a copy of your insurance! Many clients, venues, and event organizers request a COI to confirm you’re insured before working with you. It’s a standard part of doing business in many industries.

Can I Use the Same COI for Multiple Events or Clients?

Sometimes it’s fine to use the same COI for different events or clients if the coverage details match their requirements. But many events want their company name listed on your policy, which means you’ll need a new COI for their request.

Does a COI Automatically Cover the Person Who Asks for It?

No, a COI doesn’t automatically cover the person who asks for it! A COI is only proof of your coverage. To extend coverage to a qualified third party, add them as an additional insured on your policy.

Can I Create My Own COI to Give to Others as Proof of Insurance?

No, you cannot create you own COI to give to others as proof of insurance. A Certificate of Insurance must be issued by your insurer to be valid. Creating your own can be seen as falsifying insurance documents.

With an Insurance Canopy policy, you can download your COI online at any time, so you can always be ready to show proof of insurance.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.