With dance comes movement, and with movement comes risk. Whether you’re imagining choreography or guiding students across the floor, dance instruction calls for real-world protection against “what if” injuries and accidents.

By the end of this guide, you’ll understand exactly what kind of insurance dance instructors need. In fact, we’ll count you in!

Key Takeaways for Dance Instructor Insurance

- Most instructors carry general liability and professional liability insurance

- Consider additional coverage based on how you teach + where you work

- Many studios require proof of insurance, plus additional insured wording

- $2 million per claim and $3 million aggregate (total) in coverage is the gold standard

- You can get covered with Insurance Canopy for $15/month online in minutes

Quick Refresher: Why Do Dance Instructors Need Insurance?

Dance instructors need insurance to protect themselves financially in case a student is injured or their property is damaged during class or as a result of their instruction.

You teach dance because you’re passionate about it — the lines, the energy, the expression. But what happens if your student lands on their ankle wrong and blames your instruction for their injury? Can you handle a lawsuit on your own?

That’s where insurance comes in, covering the costs so you can keep moving.

The main reasons you need insurance:

- To protect your dance instruction business against expensive claims

- To meet studio, gym, fitness center, and event organizer insurance requirements

- To show your students that you’re a professional, responsible dance instructor

Pro Tip:

Lawsuits put a dramatic stop to the music, but the good news is that you can proactively lower your chances of getting sued. Discover how to minimize your risk of fitness-related lawsuits.

Insurance for Dance Instructors: The Core Coverages

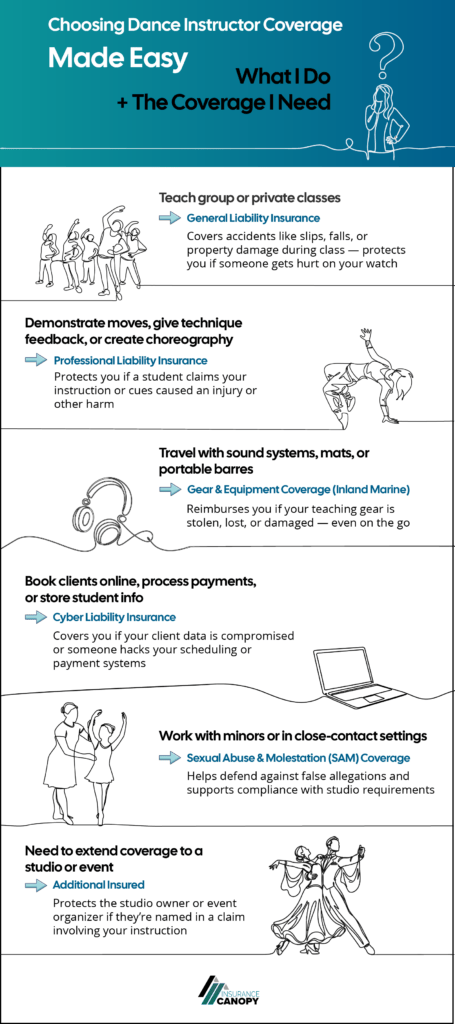

The baseline coverages every dance instructor needs are general and professional liability insurance. These two insurance types work together to protect your business from the most common claims your profession faces.

Because these coverages are so essential for dance instructors, Insurance Canopy combines them into a single base policy. Dance instructor insurance is designed for you — kind of like the solo you create to highlight a student’s unique style. It’s made to match the way you move.

General Liability for Dance Teachers

General liability insurance covers third-party injury or property damage, like if a student slips on water or a studio mirror breaks.

It’s a “catch-all” coverage for general accidents that happen while you teach. These claims may not be entirely your fault, but you could be held legally responsible for them, regardless.

General liability insurance includes several specific coverages:

- Products-completed operations coverage: Can cover you if, for example, you tape a dancer’s calf to help prevent shin splints, which causes an allergic reaction to the adhesive and a trip to urgent care

- Personal and advertising injury coverage: For non-physical damages, like if you post a video of a student without their permission or if another teacher claims you stole their choreography

- Damage to premises rented to you: Pays the studio owner or landlord if your instruction accidentally damages the space you rent

- Medical expense limit: Covers a student’s minor medical bills if they get injured, regardless of who’s at fault

Professional Liability for Dance Teachers

Professional liability insurance is designed to cover your dance instruction, specifically, if it causes injuries or damage to others.

Say you think your student is ready to try an aerial, so you guide them through the move and give the OK to go for it. They hesitate at the last second and end up injuring their neck. If your student’s parents decide to take legal action, professional liability insurance could cover you.

Professional liability insurance can respond to claims like:

- Instruction-related mistakes

- Recommendations that cause injury

- Failure to modify for your student’s ability

- Emotional distress caused by feedback

- Claims that you overstated your expertise

In short, if the claim is related to your professional service, professional liability insurance is designed to kick in and protect your business.

Pro Tip:

Enhance your insurance protection with our free dance liability waiver, a document that helps educate students about risk and sets clear expectations for your dance classes.

Smart Add-On Coverages for Dance Teachers

Start with your base of general and professional liability, then add optional coverages based on your business needs. These are some smart add-ons for dance instructors:

- Gear & Equipment Coverage (inland marine): Pays to replace your movable dance gear if it’s lost or stolen

- Cyber Liability Insurance: Helps you recover after a data breach (for example, if your students’ sensitive information is stolen)

- Sexual Abuse & Molestation (SAM) Coverage: Designed to defend you against false claims of misconduct while teaching students

- Diet & Nutrition Coverage: Covers general diet and nutrition services you offer in addition to dance instruction

Additional Insureds: Extends your coverage to a qualified third party (like a studio owner); often required for contract employment

Easy-to-Understand Dance Coverage Examples

A student says they sprained their ankle because of your choreography

Coverage You Need: Professional Liability Insurance

A student trips over another student’s dance bag before class

Coverage You Need: General Liability Insurance

Your dance gear is stolen from your locked car

Coverage You Need: Gear & Equipment Coverage

A hacker steals your students’ credit card details

Coverage You Need: Cyber Liability Insurance

A parent wrongly accuses you of improper conduct

Coverage You Need: Sexual Abuse & Molestation Coverage

A student files a lawsuit against you and the dance studio

Coverage You Need: Dance Instructor Insurance + Additional Insured

How Much Coverage Dance Teachers Need

The ideal amount of coverage is $2 million per occurrence and $3 million aggregate. Let’s break down what this means:

- Per occurrence: The maximum amount available for one claim

- Aggregate: The maximum amount for all claims within a policy year

These numbers determine how far your financial safety net stretches when you need to file a claim. With $3 million in coverage for the entire year, you can feel confident you’re protected against costly lawsuits and focus on teaching the perfect form.

Some other important numbers and names to know are:

- Medical expense limit: How much is available for quick, no-fault coverage for minor injuries

- Occurrence-based coverage: Covers incidents that happen during the policy period, even if reported later (this type of coverage is preferred over the alternative, claims-made coverage)

- Deductible: How much you have to pay before your coverage kicks in

Insurance Canopy’s dance instructor coverage checks all the boxes with:

✔️$2 million per occurrence

✔️$3 million aggregate coverage

✔️$5,000 for medical expenses

✔️Occurrence-based coverage

✔️$0 deductible for liability claims

Getting Into the Studio: Proof of Coverage

No states legally require you to carry insurance coverage to teach dance. However, dance studios, gyms, and fitness centers often require you to have a policy before accepting you as a teacher. Meet this requirement by providing a copy of your certificate of insurance (COI).

A certificate of insurance for dance teachers is a one-page document that acts as your proof of coverage. If the studio owner (or other qualified third party) requests to be listed as an additional insured, add them to your policy. This wording will be on the COI for them to verify.

With Insurance Canopy, getting a COI is fast and easy:

- Add additional insureds online at checkout or through your user dashboard

- Generate your certificate of insurance instantly

- Save a PDF on your device for quick sharing

It takes about eight minutes or less to get covered, giving you more time to prep for your next class!

Get Covered, Stay on Beat

Insurance Canopy offers affordable, top-rated dance liability insurance to safeguard your business when it matters most. Now that you know exactly what insurance you need, why not get covered now?

Our Benefits

✔️Flexible policy options

✔️Monthly or annual payments

✔️24/7 policy access via online dashboard

✔️Friendly, licensed, U.S.-based support

✔️Backed by top-rated carriers

✔️Covers 100+ fitness styles

✔️Instant proof of coverage

✔️Coverage follows you

Get coverage that keeps up with every step, spot, and spin. We’ll count you in: 5, 6, 7, 8…

FAQs About the Types of Insurance for Dance Instructors

Do I Need Both General and Professional Liability Insurance (E&O)?

Yes, you need both general and professional liability insurance (also known as “errors and omissions” or E&O). General liability protects you from slip-and-fall and property damage claims, while professional liability specifically covers your dance instruction in case of accidents.

To safeguard your dance instruction business, it’s crucial to follow fitness injury prevention tips and carry liability coverage as a financial safety net.

Am I Covered at Multiple Locations?

Insurance Canopy’s dance liability coverage follows you wherever you work, so you’re protected while you teach at multiple locations, off-site workshops, or through online and virtual classes.

Does My Studio’s Policy Cover Me?

Your dance studio’s insurance policy is designed to cover the studio, not you. While you may have limited coverage under their policy, it’s crucial to carry your own liability policy for the strongest protection.

I’m a Student Instructor. Can I Buy Coverage?

Yes, you can buy Insurance Canopy coverage if you’re a student instructor! You’re eligible for the same top-rated protection as seasoned, professional dance instructors.

Occurrence vs Claims‑Made: What’s The Difference?

With occurrence-based coverage, you can file a claim at any time, as long as the event happened while your policy was active. With claims-made coverage, you can only file a claim during the policy period.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.