Launching your own small cleaning business is a lot of work, but getting the right insurance coverage to protect your business doesn’t have to be. We’re here to help with a guide that walks you through the types of cleaning business insurance you need, how to get covered, and what to prepare before applying.

Get your contract-ready small cleaning business insurance checklist now.

What “Contract-Ready” Looks Like for Small Cleaning Companies

Before you’ll be able to finalize most cleaning contracts, you’ll need a few things. One of those things is liability insurance.

Small business liability insurance is insurance that covers injuries, property damage, or other harm your work accidentally causes others. For example:

- Someone trips over your equipment and gets hurt — liability insurance is designed to help pay for their medical expenses

- You spill a cleaning chemical and stain a client’s expensive wool area rug — liability insurance may help repair or replace it

Most cleaning clients will require proof of insurance before hiring you. And it’s often a requirement for corporate and ongoing cleaning job contracts. It ensures that if an accident does happen, there will be coverage available to pay for it.

Plus, the costs of accidents, claims, and lawsuits can reach hundreds, thousands, or even hundreds of thousands of dollars. Most small businesses don’t have that kind of cash on hand.

Documents You’ll Need to be Cleaning Contract-Ready

To be “contract-ready” (ready to sign job contracts), you should have your business, insurance, and other legal documents ready to go. Providing copies of these forms upfront helps you get to work faster by reducing time spent on sending paperwork back and forth.

Documents to have on hand for cleaning job contracts:

- Business license and registration certificates: To show you’re properly licensed and authorized to provide cleaning services

- Employer Identification Number (EIN): For tax purposes

- W-9: For tax purposes

- Doing Business As (DBA) certificate: If your business name differs from your legal name

- State or city operating permit (if required in your area)

- Certificate of Insurance (COI): To show you have the proper insurance coverage

- Additional insured certificate: If you need to list a client as an additional insured, you can get a COI with their name on it

- Bond or Janitorial Bond certificates (if required)

Training documents or certificates (if relevant): To provide proof that you have the proper safety and/or skills training

What Type of Insurance Does My Small Cleaning Business Need?

We built this checklist to help you spend less time reading about insurance and more time working. Get yours now and start planning your cleaning business launch with confidence.

Required Coverages for Cleaning Businesses

General liability is the most essential type of insurance for all small businesses. This is the coverage that applies to most injury and damage claims that could be made against you or your business.

General liability policies from different providers may include different coverage details, rules, exclusions, or “sub-types” of coverage. For example, Insurance Canopy’s cleaning business insurance includes:

Optional Add-On Coverages

Depending on your state and employer, you may be required to carry some of these additional coverages. Insurance Canopy allows you to add these to your general liability policy as needed, so you only pay for what you need.

The most frequently required additional coverages include:

- Additional Insureds: Employers or clients may require you to list them as an additional insured on your policy in case they’re named in a lawsuit alongside you

- Commercial Auto Insurance: If you own or operate a vehicle for work purposes, you need commercial auto insurance to cover accidents, vehicle damage, and liability costs

- Janitorial Bonds: Coverage that applies to theft and dishonest acts committed by your employees, so if an employee steals from a client, the bond pays the client back

- Workers Compensation: If you hire workers, this coverage pays for medical bills and lost wages if one of them gets hurt

The following add-on coverages aren’t typically required by state laws or individual employers, but help you better protect your business:

- Tools and Equipment (Inland Marine): Coverage for your mobile/transportable business tools and equipment in case they’re damaged or stolen

- Cyber Liability or Data Breach Coverage: Coverage for cybercrime, like if your digital systems are hacked or your clients’ data is stolen

Excess Liability or Umbrella Coverage: Allows you to increase your coverage limits, so you have a higher total payout amount available

How Much Does Insurance Cost for Small Cleaning Businesses?

The cost of small cleaning business liability insurance is dependent on several things, including:

- Your location

- The size of your business

- The types of coverages you have or opt to add on

- Your coverage limits

- Your claims history

Starting at just $39/month or $435/year, Insurance Canopy offers small cleaning businesses comprehensive, customizable insurance coverage tailored to fit your needs. Compared to other insurance companies, Insurance Canopy is also one of the most affordable providers currently on the market.

What You Need Before Applying for Insurance

How do you decide what insurance types are most crucial for your business, and how do you get insurance once you do?

- Identify your local laws and regulations: Find out if your state has cleaning business liability insurance requirements or rules about insurance for specific services types

- Match your risks to coverage types: You’ll need at least general liability insurance (and if you’re worried about missing an important coverage option, contact us to speak with a licensed, non-commissioned agent for help)

- Shop and compare: Compare cleaning insurance providers’ coverage options, coverage limits, prices, and customer reviews

- Gather your business details: Have as much information about your business as possible readily available

- Purchase coverage

Pro Tip: Some insurance companies, like Insurance Canopy, allow you to get same-day coverage. Others require 24-48 hours to process your application or to produce a certificate (aka proof) of insurance.

Get Contract-Ready Liability Coverage With Insurance Canopy

Getting insured and ready for business is quick and easy with Insurance Canopy’s 100% online process. In as little as 10 minutes, you can fill in your information, get an instant quote, and have proof of coverage. Here’s how to get started:

- Answer a few questions about your business

- Choose the coverage you need

- Get a quote

- Input payment information and get instant proof of insurance

Common Questions About Small Cleaning Business Insurance Needs

How Do I Get a Certificate of Insurance (COI) and Add an Additional Insured?

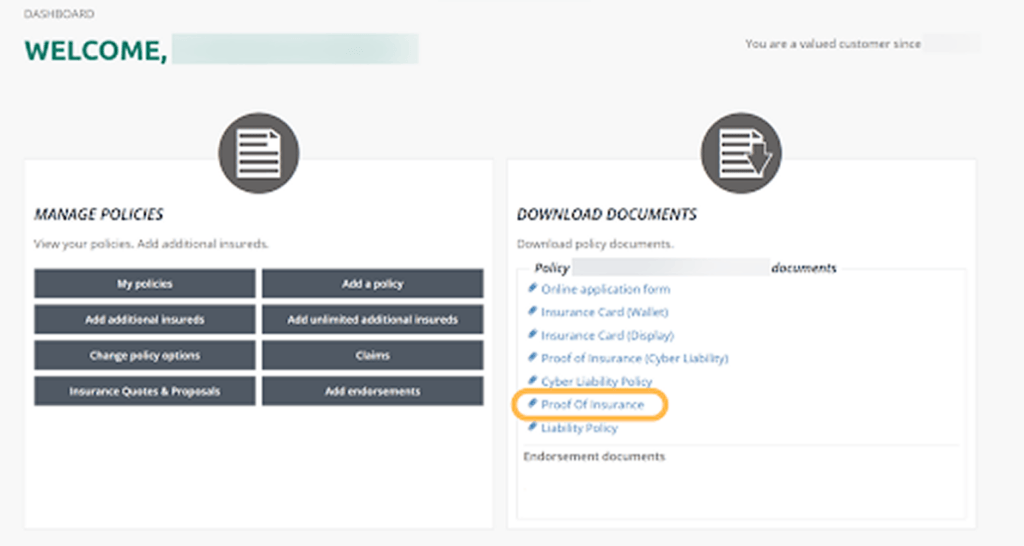

Get copies of your COI and add additional insureds to your policy anytime through your online user dashboard.

To get your COI, simply log in to your account and click on “Proof of Insurance” under the “Download Documents” section. Or, click on “My Policies” and select “Proof of Insurance” under “Download Documents

To add an additional insured after you’ve already purchased a policy, navigate to the “Manage Policies” section and click on “Add additional insureds.”

Does Cleaning Liability Insurance Cover My Employees?

Liability insurance does not apply to injuries sustained by your employees. It only covers harm your business does to others: people who are not you or anyone who works for you. You need Workers Compensation insurance for employee injuries.

Liability insurance is designed to cover unintentional injury or damage caused by your employees while they’re on the clock.

Are 1099 or Contract Workers Protected by My Policy?

It depends on your policy and your state laws. If you hire independent contractors, they may need to have their own liability insurance policies (with you listed as an additional insured on their policy.)

Workers comp policies typically do not cover independent contractors. However, this also depends on your state. And if you misclassify someone as a contractor instead of an employee, or if the state updates their regulations, you could be held responsible for benefits and penalties.

TL;DR: Check with your state workers comp laws.