TL;DR: How to Get a COI for My Business

- Purchase small business insurance from Insurance Canopy

- Create a password and log in to your user dashboard

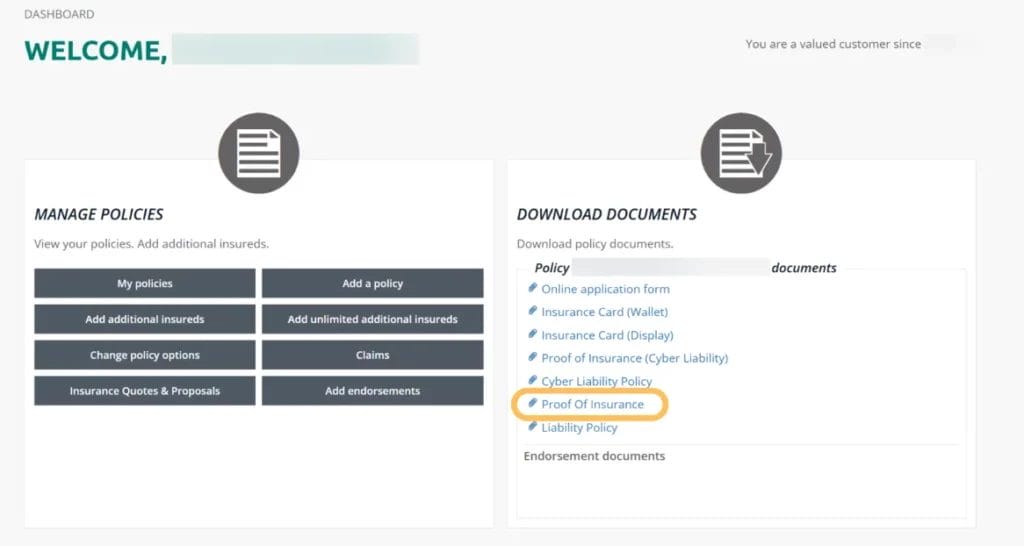

- Click “Proof of Insurance” under “Download Documents”

- Voila! Your COI is instantly saved to your device

First Off: Does Your Small Business Need a COI?

Let’s see if your business needs a COI. (Spoiler alert: Probably!)

Answer “yes” if any of these apply:

✅A client asked you for proof of insurance

✅You rent or lease office, retail, or event space

✅You sell at markets, fairs, trade shows, or other events

✅Your service contract includes an insurance requirement

✅You give professional advice to clients as part of your work

✅You work on-site at a client’s location where accidents could happen

✅You want proof for your own records or to reassure clients and customers

✅A venue or organizer has asked to be listed as an additional insured on your policy

Checked at least one box? Congrats, you need a COI! Let’s get you that ticket to more contracts, gigs, and opportunities.

How Fast Can I Get a COI for My Business?

With Insurance Canopy, you can secure a certificate of insurance in three ways: instantly, in a few minutes, or within a business day. Here’s how to get a COI fast.

Right Now

If you’re already an Insurance Canopy policyholder, your COI is waiting for you to download instantly from your user dashboard. All you have to do is log in and navigate to “Proof of Insurance.” Once you have your copy, you can email or text it to any client or partner who needs it.

In 10 Minutes

If you don’t have coverage yet, you can buy a pre-packaged policy from Insurance Canopy in under 10 minutes. Most small business owners can get covered online (without having to talk to anyone), download their COI, and get back to work — all in the same day!

In 24 Hours

Some small businesses with more unique coverage needs need a little extra attention. That’s where our licensed agents come in to create a policy personalized just for you. This process takes about 24 hours from your initial application until your COI is in your hands. It’s worth the short extra wait!

Does It Cost Money to Get a COI?

Where Can I Find a Copy of My COI?

In your Insurance Canopy dashboard, you’ll see “Download Documents” on the right side of your welcome page. Click the paper clip icon that says “Proof of Insurance” to get your COI. It is available 24/7 online, whenever you need it.

Mistakes to Avoid When Requesting a Certificate of Insurance

Did you know some insurance companies make you call to request a COI? Not to mention the waiting. Yikes. With Insurance Canopy, your COI keeps up with your small business.

That being said, these are some COI “don’ts” to avoid:

- Don’t wait until the last minute: Give your client or partner enough time to receive your COI and confirm it’s good to go.

- Don’t forget to list the client or event as an additional insured if needed.

- Don’t skip checking that your COI matches the contract requirements exactly.

- Don’t assume your COI works for all contracts, especially if additional insureds or coverage limits differ from gig to gig.

What’s Actually On a COI (And When You’ll Need One)

A COI is a snapshot of your insurance policy. It includes all the important details of your coverage, like:

- Your business info

- Who the insurer is

- What kind of coverage you have (like general liability and so on)

- How much coverage you have (coverage limits)

- How long it’s good for (policy dates)

- Who else is protected (additional insureds)

Learn more: What Is a Certificate of Insurance?

When Your Small Business Will Commonly Be Asked for a COI

Here are some common scenarios where you could be asked for a COI:

- A client asking for your COI before they bring you on for work

- An event requires your COI before you can participate as a vendor

- A landlord needs your COI before you sign a lease agreement for your business

Maya, an independent photographer, is looking to grow her business. A bridal client requests Maya’s COI before hiring her to shoot the wedding. The client needs assurance Maya can pay for unexpected costs (say a wedding attendee trips on Maya’s gear and gets injured).

Maya also plans to attend an expo to promote her photography. The event organizers need her COI to reserve her booth and put her in the official event directory.

Maya is also considering renting a space to use as a small photography studio. As part of the lease agreement, the landlord requires Maya’s COI before she can officially move in.

Every small business, side hustle, and solopreneurship needs insurance — and a COI, too! If you’re new to business insurance, check out our startup business coverage guide to learn more about protecting your big business dream.

Or, ready to grab your very own COI?

Common Questions About How to Get a Certificate of Insurance

COI vs. Proof of Insurance: What’s the Difference?

They’re the same thing! A certificate of insurance is proof that you’re insured (“proof of insurance”) you can send to anyone who needs to verify your coverage.

Who Needs to Get a Copy of my Certificate of Insurance?

Clients, landlords, event organizers, or business partners may need a copy of your COI. Think of this group of people/businesses as anyone who could potentially be affected by a claim related to your business. They need to know you have the right coverage, so the risk doesn’t fall back on them.

Whether you’re just starting out or need insurance for a growing business, Insurance Canopy makes it easy to get covered, generate your COI, and send it to whoever needs it.

Why Does My Small Business Need a COI?

Beyond compliance, a COI helps you:

- Build trust with clients

- Win bigger, better contracts

- Reduce disputes if they come up

- Position yourself as a professional

Small businesses need specific types of coverage, and your COI is proof that you take your business seriously and have the coverage to back up your work.

What’s On a Certificate of Insurance?

A COI is like a condensed version of your policy — it highlights all the essential details like coverage, limits, and additional insureds. Learn how to read an insurance policy like a pro.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.