“I don’t need insurance if I have an LLC.

If I have a claim, I can just file for bankruptcy instead.”

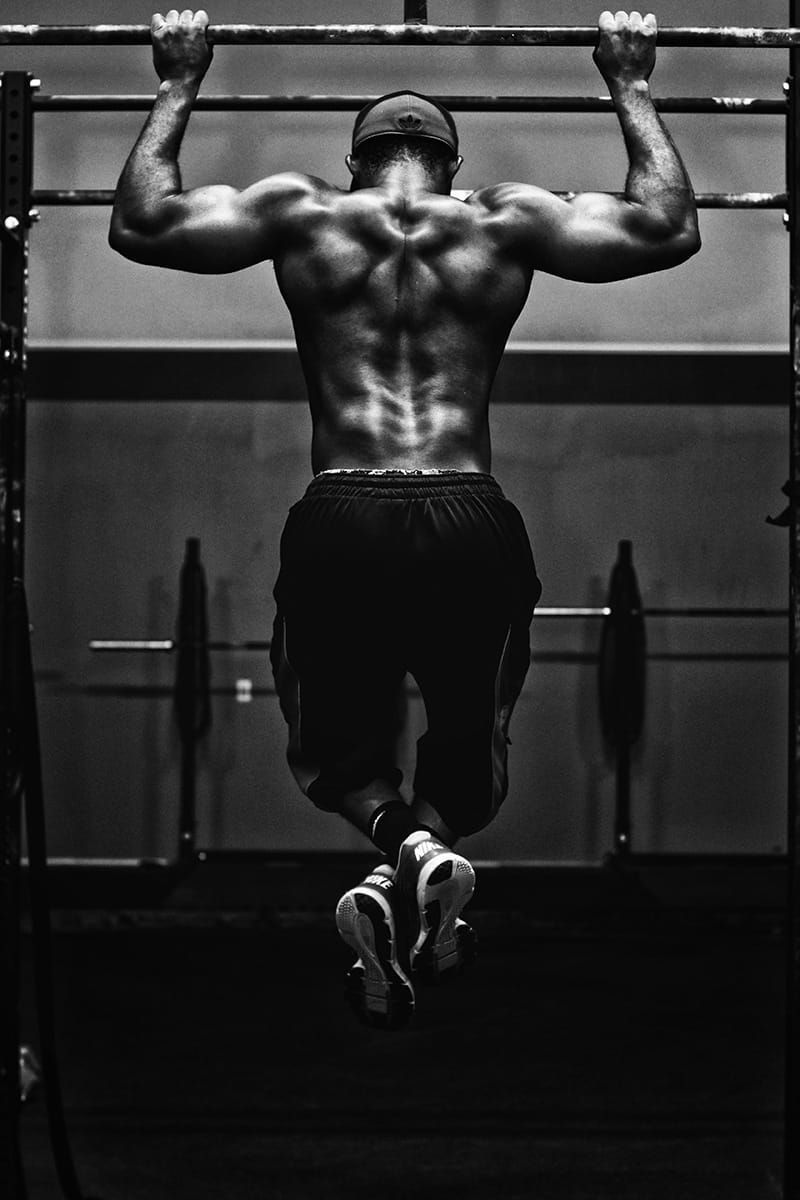

As a personal trainer, you put a lot of time and money into your education, your career, and your business.

To make things easier, you may find ways to save money on tasks or programs—getting personal trainer insurance shouldn’t be one of them.

Filing for bankruptcy is a serious action that shouldn’t be taken lightly or thought of as a replacement to insurance. When you are faced with a large claim, this may sound like a good idea to you. But in the long run, you could be facing years of financial consequences.

It may be difficult to apply for credit cards, open bank accounts, get a new car, buy a house or rent an apartment, or find employment for years to come. In fact, most banks will never consider financing another business or LLC of yours if you have a history of bankruptcy.

A lot of this stress can be avoided by taking the right steps now to protect your business and be prepared for future claims. With personal trainer insurance, you could have most, if not all, of your claim expenses covered—without the negative consequences bankruptcy brings.

Looking To Get Personal Trainer Insurance Fast?

Get a policy online today in just 10 minutes or less from Insurance Canopy and download your Certificate of Insurance instantly.

Insurance Canopy’s personal trainer insurance starts at $159. Depending on where you live, the fee to start an LLC can range from $40–$500. Even if you had a policy for three years, you would only be paying $387.

Look at it this way: the average cost of a personal trainer liability claim is $29,582.53*. This can include paying for medical bills, lost wages, legal fees, and more. Imagine having to pay that over the course of a few years and have the effects of bankruptcy impacting your future plans.

By combining general and professional liability, Insurance Canopy’s personal trainer insurance covers many common claims trainers face. Plus, you can personalize your policy to meet your specific needs.

“Insurance is too expensive, using an LLC for claims is a cheaper option.”