If there is something we can count on besides death and taxes, it would be insurance claims. Working in the entertainment industry, there are potential claims all over the place! Today we will review common claims that entertainment insurance may cover for you one day!

Remember that claim scenario circumstances vary in nature and similar claims do not guarantee coverage. Each instance is unique and we assess all claims based on your individual circumstances.

Claim 1: Property Damage

Are you prepared to repay a local venue for damage to their floor? One very common claim we see for entertainment insurance is damage to stage floors and dance floors. This can happen during setup or your actual performance. If the scuffs or scrapes cannot be buffed out, resurfacing or replacing the floor could end up costing you thousands of dollars.

Floors are just one common property claim, but there are others including accidental fires to the structure or damage to the venue’s sound or stage equipment (ie. speakers being blown out or spills on the sound control board). The best solution is to carry your own entertainer insurance policy to be prepared for claims you may face.

Claim 2: Bodily Injury

Your entertainer insurance policy is designed for third-party bodily injury claims that may arise from accidents involving or caused by your business operations. This can vary widely from instances of someone tripping and injuring themselves because of sloppy cords or the layout of your equipment. One jolly holiday performer had an accident, dropping a young child who was visiting Santa Claus. This resulted in a claim for his business, which was not covered by the mall where he worked.

Bodily injury claims can cost you thousands of dollars out of pocket for medical expenses and loss of income based on various circumstances. You aren’t in control of IF you will receive a claim because you are not in control of the people attending performances. Best to be safe and purchase an entertainment insurance policy.

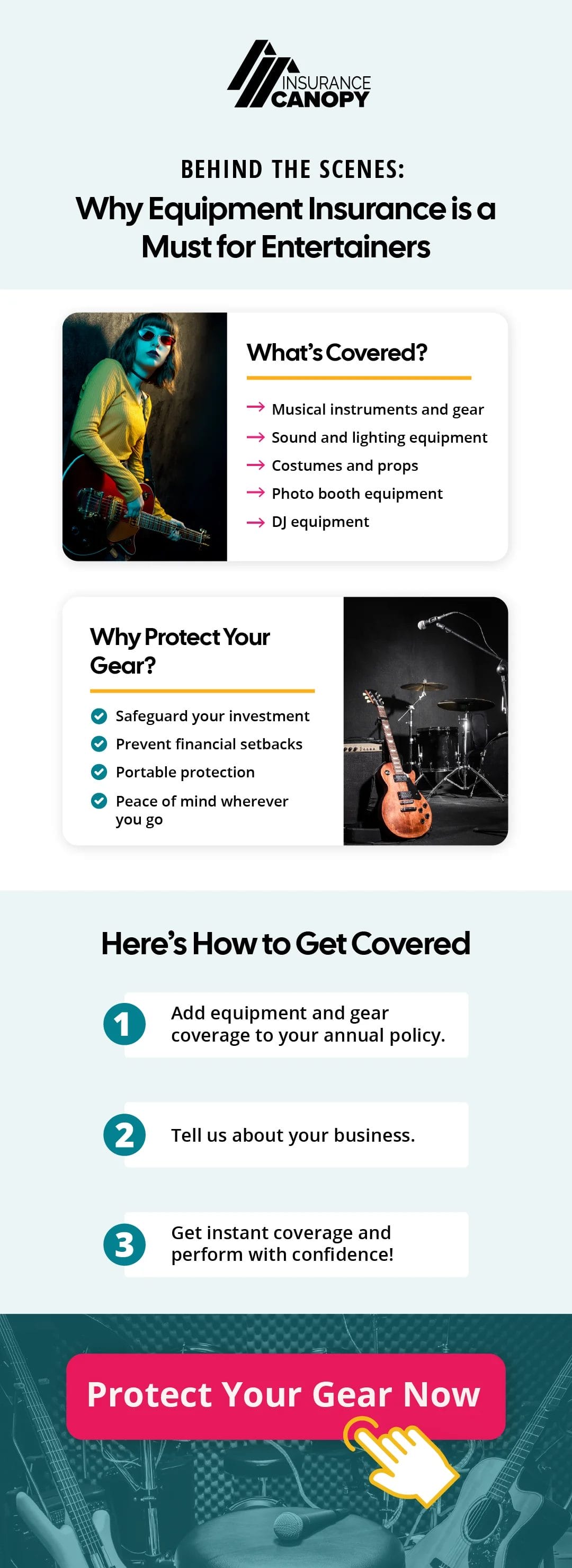

Claim 3: Your Personal Property

Did you know that you can elect to have your own stuff covered in a first-party claim? We call it Tools & Equipment coverage, sometimes it is called an Inland Marine policy. This added option may cover your tools, gear, and equipment as it travels with you to gigs in the event it is stolen or damaged.

Accidents involving spilled beverages, shorting out circuit boards, and items that are stolen are common enough, there is no specific example to give you!

Could you afford to replace your sound setup if it was damaged in the rain at an event? Many of the expenses in starting up your own business come from buying the necessary equipment. Think about repaying all of those costs out of pocket. Choose to add Tools & Equipment coverage to your annual policy. (Not available on event policies.)

Purchase Insurance Coverage

Now you can see how useful entertainment insurance is, after reviewing a few of the claims, it is time to purchase today! Visit Insurance Canopy to check out the best coverage from lawsuits, third-party damage claims, or accident claims. Buy your own entertainer insurance policy now for annual or event-only coverage.