Cleaning Business Insurance

Sweep away risks with affordable insurance for cleaning mishaps, damage, and lost gear—let your business shine!

- Wallet-Friendly Coverage

- Built for Small Businesses

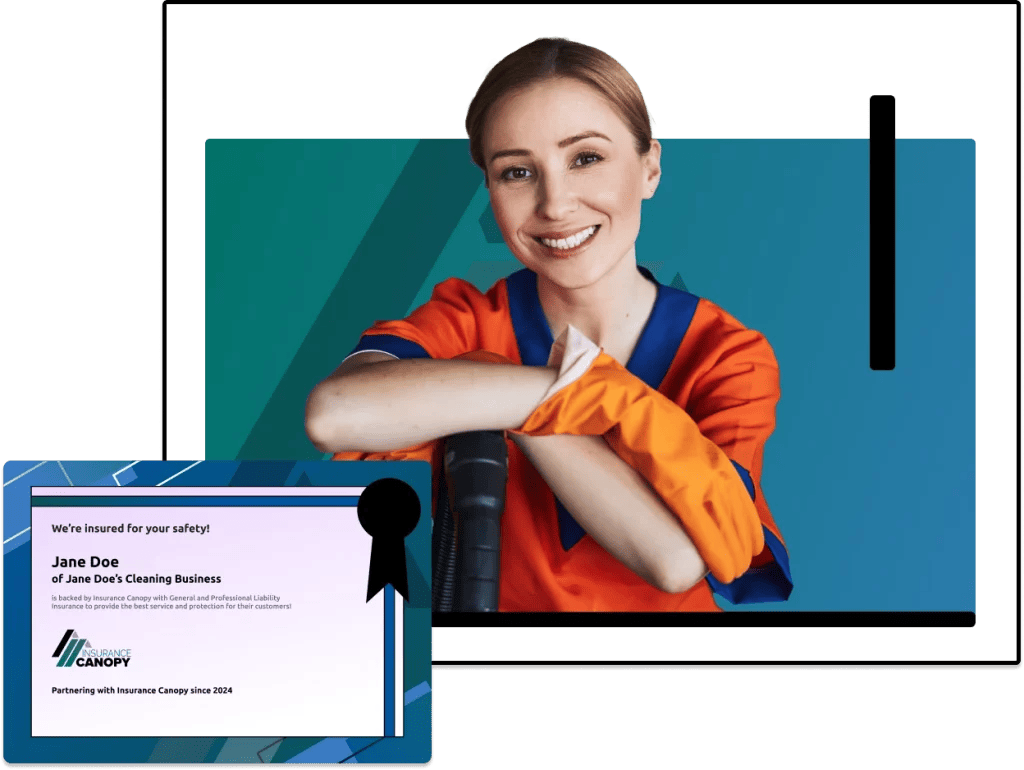

- Instant Proof of Insurance!

Tailored To Your Cleaning Business Profession

Along with the professions listed below, we also provide insurance for small cleaning businesses, commercial cleaning businesses, residential cleaning businesses, and self-employed cleaners.

Why Do Cleaning Businesses Need Insurance?

Paying a premium for cleaning insurance can feel like just another expense—until a big claim hits. From accidental property damage to injuries sustained by employees or clients, claims in the cleaning industry are more common than you might think! Without proper insurance coverage, these risks can lead to substantial financial losses and legal liabilities.

If you shatter a client’s priceless vase

General liability insurance covers on-the-job property damage.

If a “wet floor” sign goes unnoticed, resulting in injuries

General liability coverage can cover medical and legal fees.

If a client accuses your staff of theft

Janitorial bonds protect your business against claims of employee dishonesty.

If your cleaning supplies get stolen

Tools & Equipment coverage replaces stolen goods, good as new.

How Much Does Insurance For Cleaning Companies Cost?

Our cleaning company insurance starts as low as $39 per month. Several factors can influence the final cost, though, so be sure to understand exactly what goes into your cleaning insurance costs. You can also save up to 12% with annual payments!

“Signing up was easy. It’ll give any client the comfort of knowing that you have coverage.”

Plus, it’s a good, affordable coverage that covers what I need. I definitely recommend it to people—including my son and those in other industries. I tell them to call Insurance Canopy and get covered, because it’s not overly expensive. When other people in the cleaning industry say they’re not insured, I say, “Why? It’s literally $39 per month.”

– Nicole H., Owner of Nothing But Perfection

Protected by Insurance Canopy Since 2022

Recommended Insurance Coverage and Bonds for Cleaning Businesses

Our cleaning business insurance offers general liability coverage required for client contracts. We recommend adding extra coverage for worker injury, employee dishonesty, and theft or loss of supplies. Review excluded activities before purchasing.

Included

General Liability Coverage

General liability insurance (Public Liability) for cleaning businesses protects cleaners from claims related to bodily injury, property damage, or personal injury that may occur during their work. For instance, if a client trips over equipment while the cleaner is working on-site, general liability insurance can help cover medical expenses and legal costs associated with the incident. However, this coverage does not extend to you or your employees; it only protects clients or the public if they are injured on your property or as a result of your employee’s actions.

Add-Ons

Tools and Equipment Coverage

Tools and equipment coverage, also known as inland marine, provides protection for the valuable equipment used by cleaners. This insurance steps in when your trusty tools get damaged or stolen while on the job.

Janitorial Bonds

A staple in the cleaning world, bonds help protect your company against employee dishonesty. Because your staff often works unsupervised among clients’ valuables, this can lead to theft, causing financial loss and damaging client trust.

For the best coverage against theft, combine general liability insurance with a bond. At Insurance Canopy, you can buy a bond starting at $110/year.

Additional Insureds

Adding an additional insured allows another individual or entity to be protected under your policy. This is particularly important for commercial cleaners, as many commercial or government cleaning contracts require that they be added as an additional insured. This ensures that both you and your clients are covered in case any incidents or claims arise on the job.

Cyber Liability Coverage

If your business faces a cyberattack or data breach, this insurance covers the costs of getting back on your feet, like legal bills, notification expenses, and credit monitoring for affected individuals.

Workers Compensation Coverage

Workers compensation for cleaning businesses covers medical expenses and lost wages if an employee is injured on the job. For example, if an employee slips on a wet surface, sustains an injury from heavy lifting, or suffers carpal tunnel from repetitive cleaning, this policy can help cover medical costs incurred.

Required in most states, workers comp not only protects your business from lawsuits and fines but also demonstrates to your team your commitment to their safety.

Commercial Auto Coverage

Commercial auto insurance is essential for cleaning businesses. Whether you’re transporting vacuums, carpet cleaners, or crews between job sites, accidents can occur on the road. Commercial auto insurance covers vehicle damage, medical expenses, and liability claims, from fender benders to major collisions.

Most personal auto policies won’t cover vehicle use for business — making commercial auto insurance required in many states. Protect your business, your drivers, and your equipment every time you hit the road.

Coverage Limits for Cleaning Business Insurance

Maximum Cleaning Liability Insurance Limits

The most your policy will pay in a 12-month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold, or distributed.

$2,000,000

The maximum your policy will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business services.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

- False arrest, detention or imprisonment

- Malicious prosecution

- Wrongful eviction or wrongful entry

- Oral or written publications that slander or libels a person or organization

- Oral or written publication or material that violates a person’s right of privacy

- The use of another’s advertising idea in your advertisement

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$100,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

$5,000

Optional Coverage Options

Tools & Equipment Coverage

Limits / Occurrence / Aggregate

Premium

Deductible

$1,000/$3,000

$40

$250

$2,000/$6,000

$55

$5,000/$10,000

$60

Have questions?

Our non-commissioned, licensed agents are available to answer any questions you may have!

Monday to Friday, 8 am – 8 pm EST

se habla español

Why Cleaning Businesses Choose Insurance Canopy

For insurance cleaning businesses can trust, look no further than Insurance Canopy.

Affordable & Transparent Policies

Our policies are clear and straightforward, with no hidden surprises—providing reliable protection for your cleaning business.

Tailored for Small Businesses Like You

We’re aware of the unique risks cleaners face. Our coverage is designed to protect your expertise and support your business as it grows.

100% Online With Human Expert Support

Manage everything online with ease, while having expert 1:1 support when you need it. We’re here to assist you every step of the way.

135,000+ Small Businesses Trust Insurance Canopy

-

TLJ's Mobile Mixology, LLC had been insured with Insurance Canopy since it's inception and we have no complaints.

Tenisha J.

February 4, 2025Knowledgeable, kind, attentive and professional. She helped me to feel comfortable, well taken good care of and get the service possible.

Ed Levitt

February 3, 2025As a Massage Therapist, I was not aware until a few years ago that I did not have to be part of an Organization to get my liability insurance! I... Read More am so thankful for Canopy and to not have a shared aggregate limit with thousands of other massage therapists. Individual coverage is EXTREMELY important to Me and this coverage is very affordable!

Kristie Williams

January 30, 2025 -

This insurance has helped me secure events with my corporate and local government clients. They have great customer service and are always willing to help.

Tony Felix

January 23, 2025Representative was clear & concise in explaining specifics of the policy. Cost of policy very reasonable.

John B

January 16, 2025I’m very happy with my purchase of liability insurance for a one-off event. I was even able to edit the policy after it had been issued with the help of... Read More their representative. Everything was painless and reasonably priced.

jay gedeon

January 6, 2025 -

Super easy to use and great service; I had a little error from my part and needed to correct it customer service was super helpful they guided me through the... Read More phone step by step to solve it. I definitely will be back n the future. Thank you

Ana Zavala

January 6, 2025I needed some liability insurance for my business. The team at Insurance Canopy had great recommendations and the insurance was reasonable for the coverage. Web site and process... Read More were really easy to use.

Susan Tedesco

January 6, 2025Great coverage, excellent price, terrific customer service. I checked out a lot of different carriers and they had the best reputation and coverage. Since most venues require insurance, it was... Read More a good thing to have!

Steve Bryant

January 6, 2025 -

Was waiting for two other insurance companies to get back to me for over 2 1/2 weeks and losing money every day. Sitting here, frustrated I asked ChatGPT what... Read More the best company was for getting Energy auditing insurance. I went to insurance canopy and literally within five minutes I had a policy sitting in my inbox. Today I’ve scheduled three Energy Audits, which I desperately needed to pay off some bills. I was able to sign up for a program because now I meet the insurance requirements. This company really paid off for me and at $40 a month, I will keep using them as long as I do Energy Audits. I’m a real person my name is Chad Laibly and my company is Home Energy Assessors. You can verify that by googling it.

Chad Laibly

January 6, 2025Great and affordable insurance

Peter DAntoni

December 6, 2024Being a caricaturist, I never understood why I needed liability insurance, but it got to that point where I was missing opportunities because of it. So, I researched a bit... Read More and found that Insurance Canopy fit the bill. They were affordable, and they make it very easy to add venues, print certificates, and send verifications to vendors. So now, if someone loses a limb from a papercut, I'm covered! Thanks Insurance Canopy!

Paul McNeilly

November 12, 2024 -

I’m just saying that is easy to get the vendors insurance with this company

Silvia Delgado

November 6, 2024Definitely a great asset to my business, I have never had a problem getting what I need from IC. Good communication skills, always get help from the agents, attenuative on... Read More the phone. They provide peace of mind, that is priceless! Easy renewal process, easy COI's and painless, I don't have to worry about a thing. Thank you IC! @djrames_miami

Robert Avila

November 6, 2024Your site was extremely easy to use, I was able to get my event insured for what the event planners wanted. The price was so affordable. Even chatting... Read More with your on site chat room was easy and helpful. Most definitely will use your company again for our next events! Thank you

Rebecca Ruby

November 6, 2024 -

Quick easy sign-up convince is great

Vincent Davanzo

November 6, 2024Great to work with. Always available for assistance.

Two Pour Girls Bartending

November 6, 2024Best customer service I have ever had in regards to insurance.

Edward Findley

November 5, 2024 -

Super easy and convenient. Just renewed, thanks.

Wendy Berg

November 3, 2024Great to work with. Always available for assistance.

Courtney Araneo

November 3, 2024This is only the second year I have had this insurance. Haven't had to use it. But it's nice to know i have it. The price is great too

Vickie Sundgren

November 3, 2024 -

Canopy insurance has been great for my business. Definitely a five star definitely recommend it..

Fernando Ferreira

October 12, 2024Very easy and straight forward experience! The agent and live chat were instrumental in acquiring my policy.

Jacob Smith Jr

October 7, 2024Rey was amazing. So easy! So fast!

Herman Koch

September 30, 2024 -

Always treated well. They take care of my business insurance and I don’t have to worry about anything with insurance canopy in my corner. 10 year customer.

Mark Paquin

September 14, 2024Excellent rates and coverage! Did a lot of homework before going with Insurance Canopy, by far the best bang for the buck 🙂

Alana Wyld

September 14, 2024She is positive and friendly !

Alan Dynin

September 14, 2024 -

Had a great experience obtaining a policy quickly for a solo musical act. After a year, modified my policy to a fully staffed production easily using the chat feature of... Read More the website. Very satisfied! I highly recommend Insurance Canopy to all musicians and artists. .

Paul Tolle

September 6, 2024I am a professional mobile DJ. I use Insurance Canopy for a policy to cover my equipment and liability. They are easy to do business and the website makes... Read More it easy to make changes to my policy if I need to. Lastly, the cost of my insurance is very reasonable!

Don Kirby

September 6, 2024Best price I have found! Excited to be a customer

Dustin Price

September 6, 2024

-

TLJ's Mobile Mixology, LLC had been insured with Insurance Canopy since it's inception and we have no complaints.

Tenisha J.

February 4, 2025 -

Knowledgeable, kind, attentive and professional. She helped me to feel comfortable, well taken good care of and get the service possible.

Ed Levitt

February 3, 2025 -

As a Massage Therapist, I was not aware until a few years ago that I did not have to be part of an Organization to get my liability insurance! I... Read More am so thankful for Canopy and to not have a shared aggregate limit with thousands of other massage therapists. Individual coverage is EXTREMELY important to Me and this coverage is very affordable!

Kristie Williams

January 30, 2025 -

This insurance has helped me secure events with my corporate and local government clients. They have great customer service and are always willing to help.

Tony Felix

January 23, 2025 -

Representative was clear & concise in explaining specifics of the policy. Cost of policy very reasonable.

John B

January 16, 2025 -

I’m very happy with my purchase of liability insurance for a one-off event. I was even able to edit the policy after it had been issued with the help of... Read More their representative. Everything was painless and reasonably priced.

jay gedeon

January 6, 2025 -

Super easy to use and great service; I had a little error from my part and needed to correct it customer service was super helpful they guided me through the... Read More phone step by step to solve it. I definitely will be back n the future. Thank you

Ana Zavala

January 6, 2025 -

I needed some liability insurance for my business. The team at Insurance Canopy had great recommendations and the insurance was reasonable for the coverage. Web site and process... Read More were really easy to use.

Susan Tedesco

January 6, 2025 -

Was waiting for two other insurance companies to get back to me for over 2 1/2 weeks and losing money every day. Sitting here, frustrated I asked ChatGPT what... Read More the best company was for getting Energy auditing insurance. I went to insurance canopy and literally within five minutes I had a policy sitting in my inbox. Today I’ve scheduled three Energy Audits, which I desperately needed to pay off some bills. I was able to sign up for a program because now I meet the insurance requirements. This company really paid off for me and at $40 a month, I will keep using them as long as I do Energy Audits. I’m a real person my name is Chad Laibly and my company is Home Energy Assessors. You can verify that by googling it.

Chad Laibly

January 6, 2025 -

Great coverage, excellent price, terrific customer service. I checked out a lot of different carriers and they had the best reputation and coverage. Since most venues require insurance, it was... Read More a good thing to have!

Steve Bryant

January 6, 2025

Questions You've Asked Us About Cleaning Business Insurance

Our team is always ready to help answer your questions. Smile included.

What insurance do I need to clean?

All cleaning businesses should secure general liability insurance, a common requirement in client contracts. The types of additional coverage needed can vary depending on the nature of the business. For instance, if you frequently transport cleaning supplies, consider tools and equipment coverage to guard against theft. Additionally, bonds are a valuable option in this field, offering protection against employee dishonesty claims.

Is my cleaning insurance policy effective immediately?

Yes—your insurance policy can be immediately active upon purchase! You’ll receive instant coverage confirmation and your Certificate of Insurance (COI) as soon as you complete the online application and payment. You’ll also get a badge for your website, so both prospective and current clients know you’re insured.

How do I cancel or renew my policy?

You have the option to cancel your cleaning insurance with Insurance Canopy at any time. Simply contact our customer service team, and they will guide you through the cancellation process. Check your policy terms for any cancellation fees or refund eligibility to ensure a smooth transition.

Renewing your policy is straightforward. Policies automatically renew at the end of their term to prevent gaps in coverage. You will receive an email notification prior to the renewal, ensuring there are no unexpected charges. Reach out to support if you wish to make any adjustments to your policy.

How do I file a cleaning business claim?

Filing claims with Insurance Canopy is easy! Here’s the fastest route to success:

- Log in to your dashboard

- Find “Manage Policies”

- Click on “File a Claim” and share your info

Once you’re done, a claims adjuster will get in touch to assist you. They’ll be with you every step of the way to ensure the claims process goes smoothly.

What’s the difference between General Liability and a BOP?

General Liability (GL) insurance shields your cleaning business from bodily injury, property damage, or personal injury claims. A Business Owner’s Policy (BOP) bundles GL with business interruption and commercial property insurance, but most cleaning businesses don’t need commercial property coverage. At Insurance Canopy, we skip the BOPs and focus on delivering the essential coverage you need without the unnecessary extras.

Do I need Umbrella Insurance for my cleaning business?

No, your business likely doesn’t require umbrella insurance. This type of insurance enhances your general liability (GL) coverage, usually up to $4 million, for additional protection. However, most cleaning business contracts don’t mandate such extensive coverage. At Insurance Canopy, we prioritize simplicity and don’t provide umbrella insurance, ensuring you get the necessary coverage without unnecessary extras.

Is cleaning business insurance available in my state?

Yes. We currently offer cleaning business insurance in every U.S. state except New York. If you operate outside of New York, you can get covered quickly and easily.

We have state-specific information for top cleaning business states to help you understand local requirements and costs:

Florida Cleaning Insurance

Texas Cleaning Insurance

California Cleaning Insurance

Sweep Away Stress With Our Cleaning Business Insurance

Related Articles

Why Cleaning Businesses Choose Insurance Canopy

Insurance might not be the most exciting “must-have” when it comes to your

What Happens if You End Your Cleaning Insurance Early?

Canceling your cleaning business insurance early might seem like an easy way to

Understanding Your Cleaning Business Insurance Policy: A Quick Guide

Your business deserves the best protection, and understanding your cleaning business insurance policy