How to Apply for Consulting Insurance with Insurance Canopy

No one wants to spend hours researching consultant insurance. Getting consultant insurance can be fast, simple, and built around your work. Learn how to get insurance for your consulting business in a few simple steps.

Here’s what to expect:

- How to apply in minutes

- What details you’ll need to provide

- Which coverage options fit your services

- How much it costs, and what happens after

1. Start Your Application Online

Securing consultant insurance is a straightforward process with Insurance Canopy. Our online application guides you through each step, ensuring you get the right coverage tailored to your business needs.

Use our online application link. This takes you to our secure platform — the whole process should take 10 minutes or less.

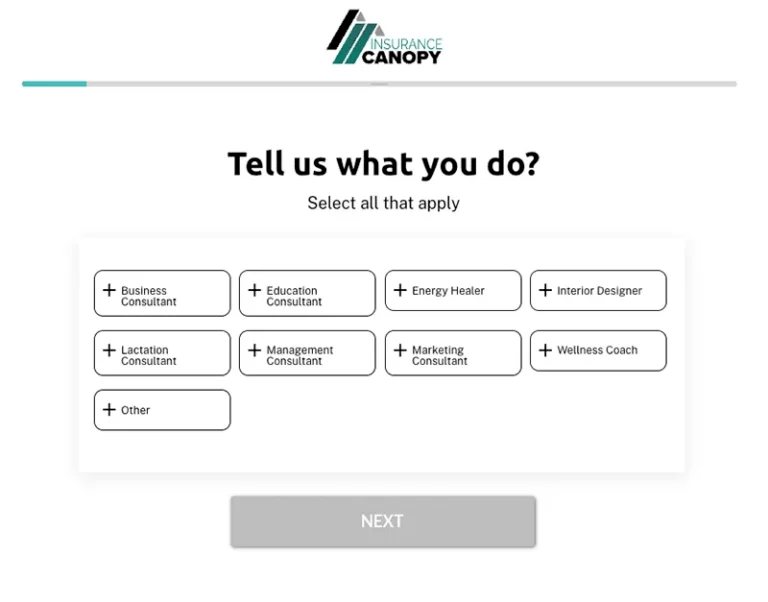

2. Tell Us About Your Business

We need to know about your business to provide the best coverage options. Briefly describe your consulting services. Your coverage depends on the nature of your work, whether you’re a management consultant, education consultant, or marketing strategist.

Business Operation Details

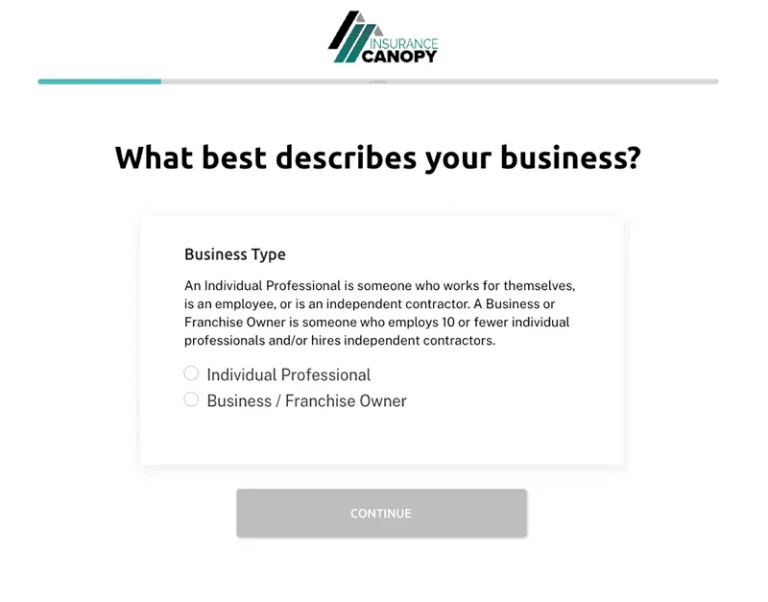

Next, we’ll ask for a few key details about how your business operates. These factors help us assess risk and provide a policy that aligns with your industry and client expectations.

Business type: Select your business structure. This helps us tailor coverage to your specific setup.

- Select “individual professional” if you work for yourself, are an employee, or operate as an independent contractor.

- Select “business / franchise owner” if you employ 10 or fewer individual professionals and run a business or franchise.

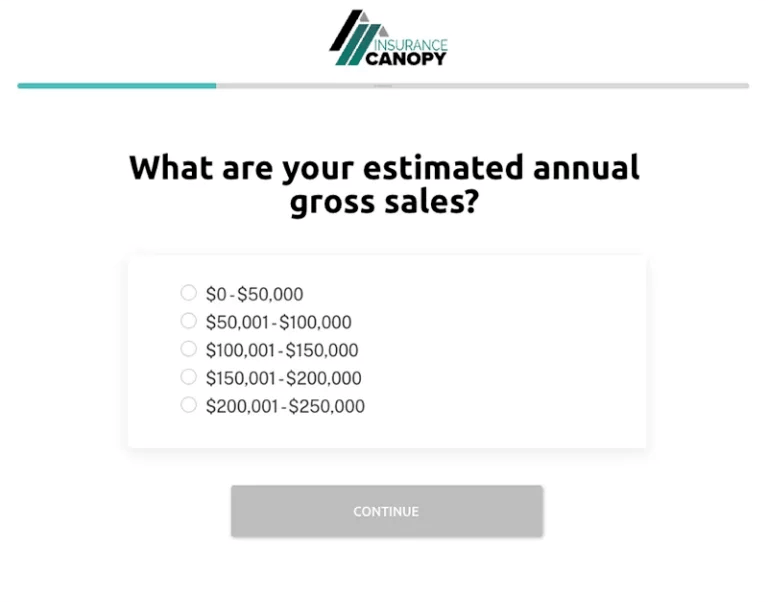

Annual gross sales: Estimate your yearly gross sales. This helps determine the appropriate coverage limits for your business size.

3. Customize Your Coverage

Consultant insurance isn’t one-size-fits-all. Choose limits that align with your risk tolerance and client contract requirements. With Insurance Canopy, professional and general liability coverage are included in the base policy, with fixed limits of $1 million per claim / $2 million aggregate (for the policy year).

- Professional liability insurance (errors and omissions): Protects against claims of negligence, mistakes, or failure to deliver services as promised.

- Example: If a client claims your strategic advice led to financial loss, this coverage helps cover legal fees and settlements.

- General liability insurance: Covers third-party bodily injury, property damage, and personal injury claims.

- Example: If a client trips over your laptop cord during an in-person meeting and gets injured, this coverage can handle medical expenses.

Note: Choose coverage limits and deductibles that match your risk exposure and protect against the most common claims in your industry.

Coverage Limits for Education Consultant Insurance

General & Professional Liability

$2,000,000

Products & Completed Operations Aggregate

$1,000,000

Personal & Advertising Injury

Included

General & Professional Liability Each Occurrence

$1,000,000

Damage to Premises Rented to You

$300,000

Medical Expense (Any one person)

$5,000

Additional Limits

Inland Marine / Business Personal Property

$4,000

Additional Coverage Options

Customization is offered through optional add-ons, allowing you to tailor your policy to fit your risk tolerance, client contract requirements, and your business’s specific needs.

Choose from the following optional add-on coverage options:

Cyber liability insurance: Protects against cyber threats and data breaches, which is essential for consultants handling sensitive client data

Example: If your consulting business falls victim to a phishing scam that exposes client information, this coverage helps with recovery costs and legal expenses.

Tools and equipment insurance (inland marine): Covers business equipment such as laptops, tablets, or specialized consulting tools against theft or damage

Example: If your laptop is stolen at a client meeting, this coverage helps replace it.

Consultant bonds: Ensures financial protection for clients if contractual obligations are not met.

License and permit bonds: Required in certain industries to guarantee compliance with regulations

Example: If your consulting business needs a specific license to operate legally, this bond ensures you meet industry requirements.

Contractor bonds: Protects clients from financial loss due to incomplete work

Example: If a project is left unfinished due to unforeseen circumstances, this bond is designed to cover the financial gap for the client.

Business service bonds: Protects against employee dishonesty or theft

Example: If an employee of your consulting firm steals from your client, this bond helps compensate the affected party.

Additional Insureds or Certificate Holders

If a landlord or a property manager requires proof of coverage, you can add them as an additional insured directly from your dashboard. This ensures they are protected under your policy at no extra cost.

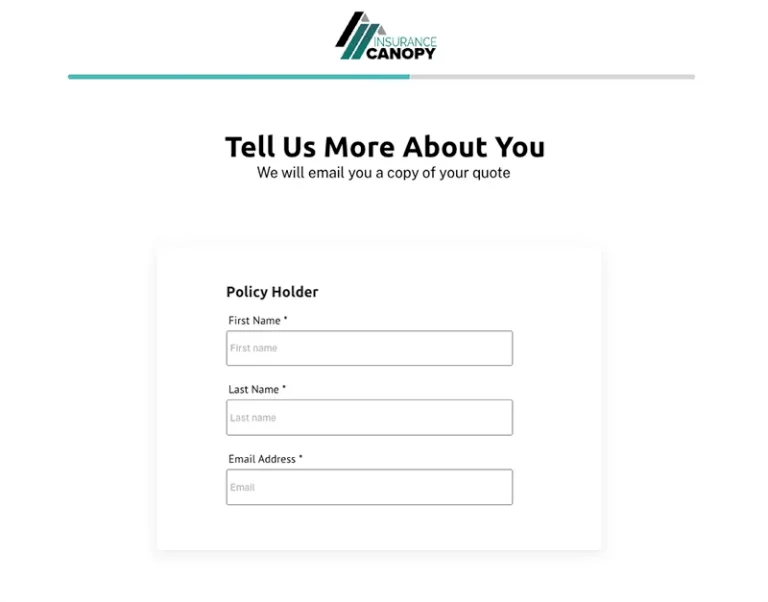

4. Finalize Your Information

You’re almost there! Before we complete your consultant insurance policy, we need a few final details about you and your business. These ensure your coverage is accurate, meets industry requirements, and aligns with your unique consulting needs.

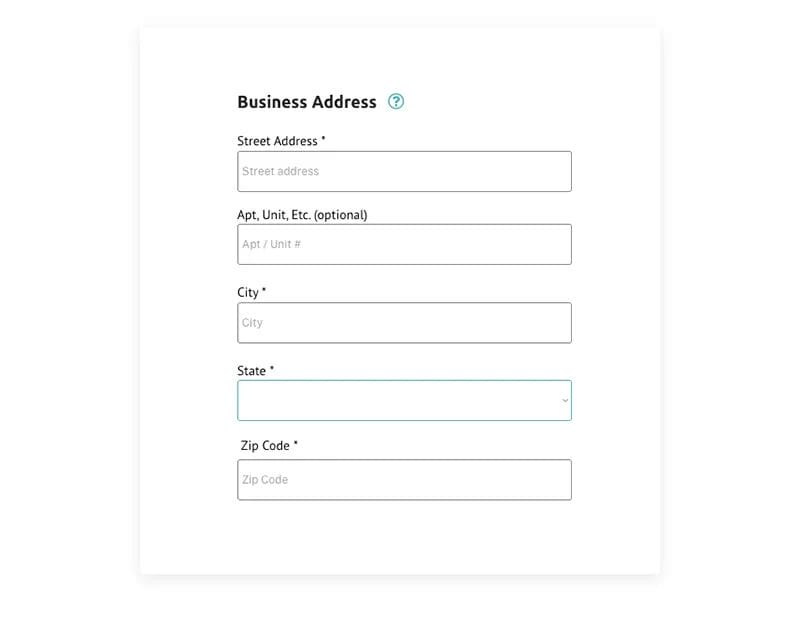

Personal Information

We’ll start with a few basic details about you. This information ensures your policy is correctly issued and linked to your business. Please provide your:

- First name and last name: The official name to be listed on your policy

- Email address: Where we’ll send your policy documents, renewal reminders, and important updates

- Business address: Your official business location, whether it’s a home office or a commercial space

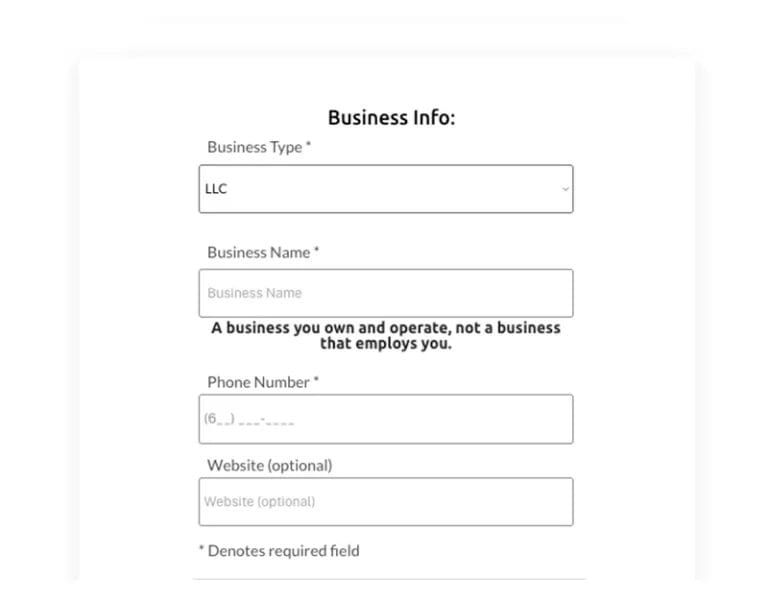

Business Information

Next, we need essential details about your consulting business to tailor your coverage properly.

- Business type: Specify your industry and consulting specialization

- Business name: Enter your official business name as it should appear on legal documents and insurance policies.

- Phone number: Provide a contact number where we can reach you regarding your policy

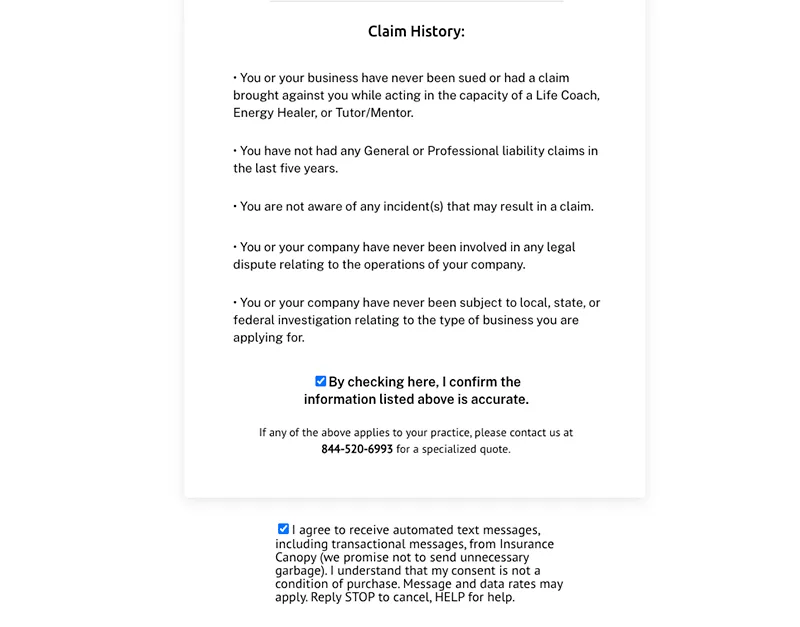

- Claim history: Let us know if you’ve had any prior insurance claims related to your consulting business. This helps us assess risk and determine the best coverage for you.

Note: Once you’ve finalized your coverage, choose the date when you want your coverage to begin. If you need immediate coverage, you can select today’s date and get insured instantly.

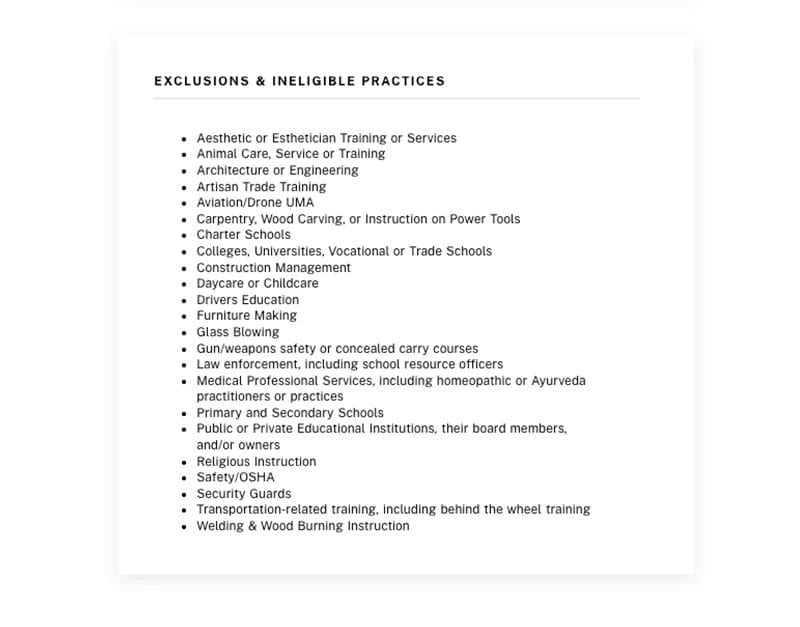

Exclusions

To make sure you’re getting the right coverage, we’ll ask a few questions about your business operations:

- Annual payroll: Does your business’s annual payroll exceed $500,000? This helps determine if additional coverage is needed.

- Industry-specific exclusions: Do you perform any services that may be excluded from coverage? We’ll clarify if any limitations apply to your policy. Here are some industries that are not covered:

- IT consultants

- Architecture

- Construction

- Safety and risk management

5. Review Your Quote

You’ll receive a detailed quote once you enter all the necessary information. This includes:

- A transparent breakdown of your policy, coverage details, and costs

- The ability to adjust limits or add endorsements if needed before purchasing

Don’t forget to double-check if your coverage meets contract requirements!

6. Get Covered Instantly

Finalizing your consultant insurance is quick and easy:

- Securely complete your purchase using your preferred payment method

- Once your payment is processed, you’ll receive a confirmation email with policy details

- Log in to your dashboard to download, print, or share your Certificate of Insurance (COI), so you can quickly provide proof of coverage to clients or business partners

What Happens After Purchasing Your Policy

Once you’ve completed your policy purchase, you’ll have everything you need to manage your coverage easily. From accessing your certificate of insurance to making updates or renewing your policy, here’s what comes next.

Access your COI: This serves as proof of coverage — many clients require it before signing a contract. Your COI is available on your online dashboard and is available to download or print at any time.

Update your coverage: Add endorsements or modify business details anytime through your online dashboard. Whether you need to make adjustments based on new services you offer, managing your coverage is simple and convenient.

Renew your policy: Keep your coverage active easily with Insurance Canopy. You’ll receive a renewal reminder before your policy expires, allowing you to renew online quickly.

Pro tip: For an even smoother experience, opt into EZ Renew, which renews your policy automatically, so you never have to worry about coverage gaps.

Questions About How to Get Insurance for a Consulting Company

Do independent consultants really need insurance?

Yes! Independent consultants are just as vulnerable to lawsuits and financial risks as larger firms. A single lawsuit for alleged negligence or a contract dispute can be financially devastating. Consultant insurance provides a safety net, protecting you from costly legal fees and claims.

What types of coverage do business consultants need?

Most consultants need at least professional liability insurance to cover claims of errors, omissions, or unsatisfactory work. General liability insurance is crucial for protecting against third-party injuries or property damage.

Depending on the type of work, some consultants may also need cyber liability or tools and equipment coverage. This easy-to-follow guide explains what kind of insurance consultants need based on their work.

How much does insurance cost for consultants?

Insurance Canopy offers affordable policies, with pricing starting at $21 per month. The cost of consultant insurance depends on several factors, including your industry, coverage limits, and business size.

Start Your Consultant Insurance Application Now!

Success in consulting isn’t just about competence — it’s about protection. A single lawsuit or unexpected claim could derail your business. Without adequate coverage, you leave your reputation and financial stability to chance. Start your application and get insured in minutes!

Allison Kirschbaum | Copywriter

Digital Content Specialist, Allison Kirschbaum leverages her experience in providing in-depth content such as blogs, whitepapers, and downloadables about insurance, liability, and the challenges small businesses face every day. Before working at Veracity, Allison freelanced her copywriting skills, including optimizing rankings and generating leads across various sectors. She is now fully trained on Insurance Canopy’s products and helps small business owners navigate their insurance needs.

Digital Content Specialist, Allison Kirschbaum leverages her experience in providing in-depth content such as blogs, whitepapers, and downloadables about insurance, liability, and the challenges small businesses face every day. Before working at Veracity, Allison freelanced her copywriting skills, including optimizing rankings and generating leads across various sectors. She is now fully trained on Insurance Canopy’s products and helps small business owners navigate their insurance needs.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.