For more than a decade Insurance Canopy has been an industry leader in providing businesses with top-rated product liability insurance. As we started to see trends in the industry, we started compiling data and pulling in outside research to gather a better understanding of product liability insurance and its role in businesses today.

The following information is a grouped study of information from Insurance Canopy and outside sources such as Lex Machina, Statista, and the Insurance Information Institute.

Non Multidistrict Litigations are lawsuits that are not classified as a class action lawsuit. For example, a large pharmacy company or multi-billion dollar manufacturer. These types of larger, class action lawsuits award hundreds of millions of dollars at a time to thousands of recipients living in different districts.

For the purpose of this study, we wanted to exclude this type of information and focus on data that more accurately reflects the types of businesses we serve at Insurance Canopy.

*For defect cases (the most common basis for a product liability lawsuit) negligence was the most common claimant win, while no breach of warranty was the most common defendant win.

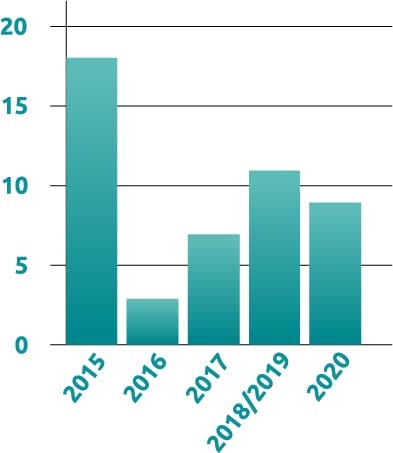

From 2015–2020, 48 claims were filed for a total estimated cost of $669,233—and an average of $25,336 in just 2020 alone. Even if you have strict product testing and carefully monitor product safety, accidents can still occur. A single claim could lead to a halt in production, damaged business relationships, and loss of customer trust.

Insurance Canopy has seen an increase in

product liability claims since 2016.

*2018/2019 policies were written for 18 month periods.

Amongst Insurance Canopy customers, most product liability claims come from manufacturers’ defects. This means there was a flaw in the design of the product, impairing functionality and increasing the risk of injuries or damages.

Because 31.6% of customers are manufacturers, and manufacturers defects are the leading liability claim, having product liability insurance can be key in keeping claim costs low.

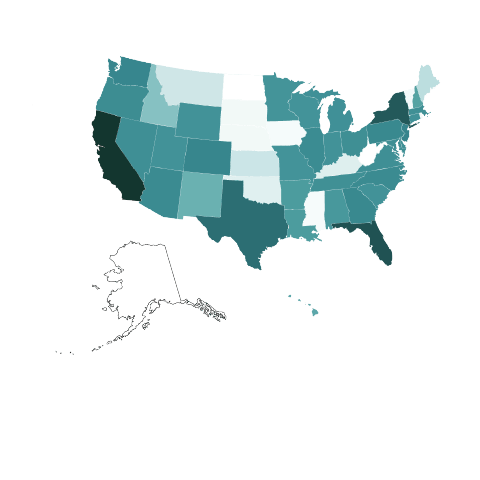

In the United States, California has the largest number of businesses that opt into product liability insurance at a rate of 18.11%.* Additionally, almost a third of businesses using product liability insurance are based throughout Florida (11.24%), New York (9.93%), and Texas (7.37%).

In terms of direct premiums, California has the highest on average ($612.45), followed by Texas ($356.87), and then New York ($348.56).

Looking at states by growth of product liability direct premiums year over year, South Dakota had the largest percentage rise at 22%, followed by Virginia (22%), and then Illinois (16.52%).

60.46% of people applying for product liability insurance sell in online marketplaces, while 39.54% sell in stores, at events, and in other physical locations.

Global ecommerce sales are projected to reach up to $5 Trillion in 2022—an estimated 20.4% of global retail sales—and $6 trillion by 2024.

In addition, 51.2% of all U.S. retail sales in 2020 went through Amazon. This equates to $386.1 billion of gross merchandising value. For comparison, Amazon had $280.5 billion of products sold in 2019, and $469.8 billion in 2021.

Other online sellers such as Etsy totaled ~$10.28 billion in sales in 2020, while eBay’s gross merchandising value (GMV) grew to $100 billion in 2020, along with drawing in over 160 million users.

Product liability claims & risks are on the rise, as is the amount of money being made through ecommerce sales. As online marketplaces continue to grow, you can expect the number of lawsuits to grow with it.

Here are some insights we think you can expect to see over the next few years:

Product liability claims & risks are on the rise, as is the amount of money being made through ecommerce sales. As online marketplaces continue to grow, you can expect the number of lawsuits to grow with it.

Here are some insights we think you can expect to see over the next few years:

Product liability claims on average leave businesses paying over double the amount of the next highest personal injury award.

To summarize, ecommerce sales have been and are projected to continue growing at a fast rate through 2026. The increase in global ecommerce sales opens opportunities for more businesses to enter the market, though barriers to entry may be higher.

Taking everything into account, having a product liability insurance policy in place with your business can help you save tens of thousands if not hundreds of thousands of dollars in terms of raw payout value, as well as avoiding the years of litigation that will take place if liability has been determined.

Regardless of businesses being strictly ecommerce, brick and mortar, or both, stricter legislation to further protect the consumer is being introduced—and product liability lawsuits will continue to rise for all businesses over the next couple of years.

“An Amazon Seller’s Ultimate Guide to Insurance” by Insurance Canopy

“2020 Product Liability Litigation Report” by Lex Machina

“Amazon And Walmart Are Nearly Tied In Full-Year Share Of Retail Sales” by PYMNTS

“Annual gross merchandise sales (GMS) of Etsy Inc. from 2005 to 2020” by Statista

“Premiums earned by the products liability insurance market in the United States” by Statista

“Facts + Statistics: Product Liability” by Insurance Information Institute

What kind of work do you do?

Search and select the closest match

Not Sure? Give us a call at 844.520.6993 to speak with a licensed agent.

Our licensed, U.S.-based agents are here for you from 8 a.m. to 8 p.m. Eastern, Monday through Friday, so they can enjoy evenings and weekends with the people who matter most.