Considering life coaching insurance but dreading the research process?

Use this zero-jargon guide to go from a liability insurance newbie to equipped and empowered in just five minutes. We’ll cover:

- What life coach liability insurance is

- Why life coaches need insurance

- A life coach’s biggest legal risks

- Types of life coach business insurance

- How to choose the right insurance for you

- How much liability insurance for life coaches costs

- 4 strategies to manage life coaching risks

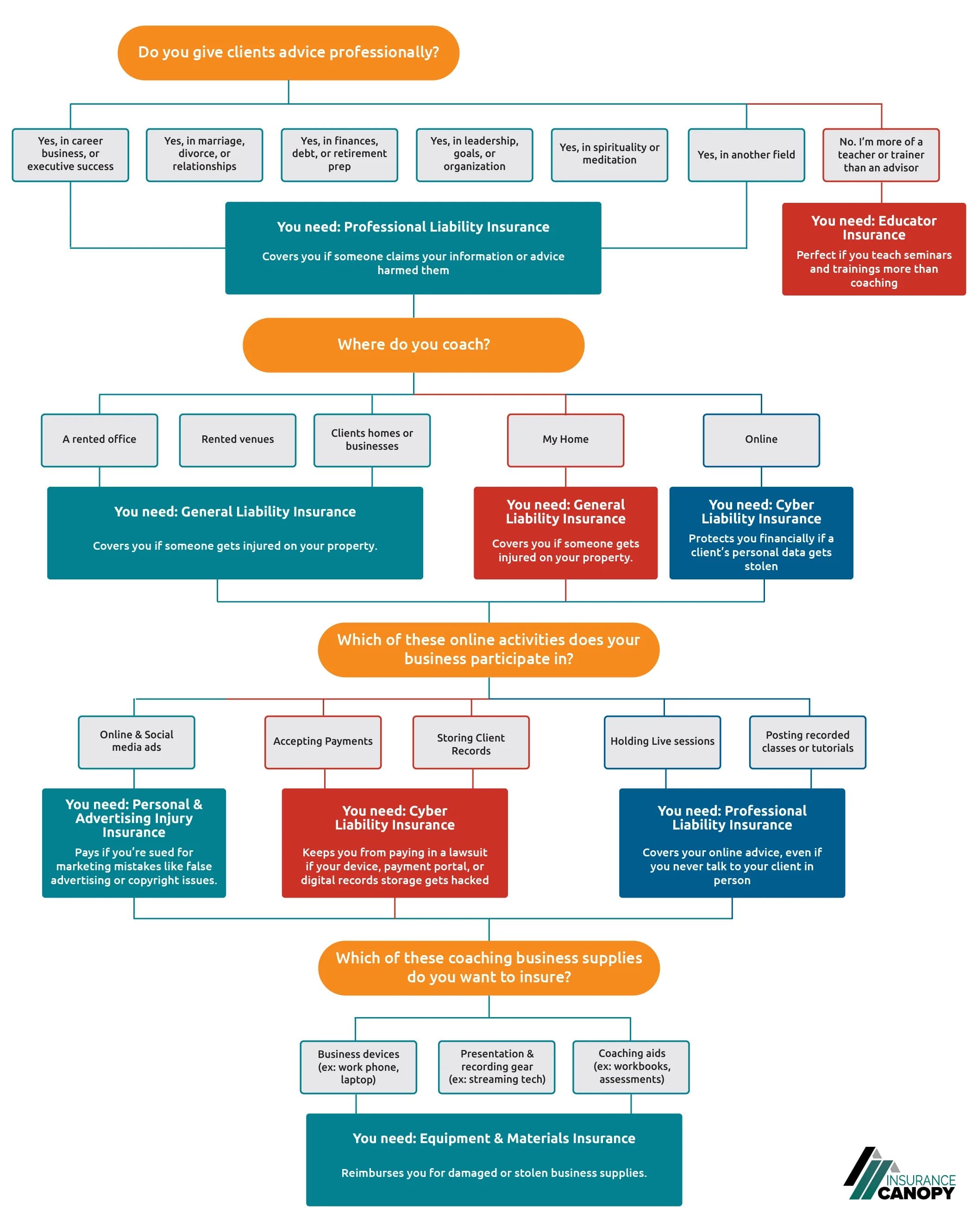

Just here to get insurance? Check out our handy flow chart that guides you through choosing the right life coach insurance for you!

What Is Life Coach Insurance?

Life coaching insurance pays for legal claims you could face related to coaching. If a client blames you for their lack of results or you accidentally let confidential information slip, you could be responsible for paying thousands of dollars in damages.

Legal fees are enough to sink many coaching businesses without insurance. Life coaching liability insurance keeps you financially afloat by paying the bill for you if an accident happens. You pay in a little over time with policy payments so that insurance can pay out later.

Why Life Coaches Need Insurance

✅ Life Coaching Is Mostly Unregulated

You don’t need a license or degree to start a life coaching business. While you might think fewer rules mean fewer legal issues, regulated fields like counseling and medicine also create boundaries around your practice. Recent high-profile life coach lawsuits show how serious it is when your guidance crosses the line into a licensed field.

Insurance won’t protect you if you break laws, but it can pay your costs if you’re accused of mistakes like negligence or “bad” advice that causes emotional distress.

✅ Professionalism & Preparation Make You Stand Out

Because life coaches aren’t legally required to be certified or insured, some choose to skip those steps — but just because you can, it doesn’t mean you should.

Like a life coach certification, life coaching insurance shows you’re a serious professional with an organized, prepared business. For clients who aspire to add order and structure to their relationships, routines, and careers, that’s pretty compelling.

✅ Clients Might Not Know the Difference Between Life Coaching & Therapy

Even if you stay within the limits of your practice and do everything right, clients may want advice you’re not allowed to give. Many people don’t understand the difference between a life coach and a therapist, which can create unrealistic expectations for clients. When these aren’t met, clients may sue. Insurance acts as a financial safety net in situations like these.

✅ Coaching Contracts Don’t Guarantee Safety

Coaching without a client contract is like driving on a highway without lanes. Drawing clear boundaries around what your services include and what clients get for their money manages expectations and helps you avoid legal action. Even so, a contract is an extra layer of protection, not a guarantee. If a suit doesn’t go your way, you want insurance in your corner.

✅ Sometimes Things Just Go Wrong

From property damage during a client’s in-home visit to cyberattacks that steal your clients’ credit card info, even careful coaches can’t predict everything. Life coach liability insurance is customized to cover your practice’s most serious risks and vulnerabilities.

A Life Coach’s Biggest Legal Risks

Unsatisfied Clients

Unrealistic expectations about timelines for success, coaching outcomes, and return on investment may lead clients to blame your advice. Even if you did nothing wrong or the suit is eventually dropped, legal action can strain your wallet and drag on for months or years.

A client sues a divorce coach for negligence, claiming poor guidance led to custody judgments not in their favor. $100,254*

A client claims a career coach’s advice led to severe financial loss they weren’t prepared for after they accepted a pay cut to work in a new field. $50,000

*All claim amounts in this article are estimates based on internal knowledge and research. Every insurance policy has conditions, limitations, and exclusions, so read your policy carefully to be sure you understand what’s covered.

Professional Mistakes

Clients open up to you about the most sensitive areas of their lives. If you accidentally share details of their personal situation or misstep in your recommendations, clients can sue you for errors like breach of confidentiality or negligence.

A relationship coach accidentally tells sensitive details about one client to another, violating their confidentiality agreement. The client sues for breach of privacy and emotional distress. $51,734

A career coach’s advice about getting a promotion leads to a client losing their job. $35,000

Breach of Contract

When you fail to deliver on the hours, sessions, or services in your client contract, you can be legally responsible for any financial harm that comes from the broken contract.

A client sues because a business coach suddenly ended services, leaving them without support while trying to set up a new company. $20,000

A leadership coach fails to provide the agreed number of sessions and leaves their client with unmet goals. $10,000

Online & Marketing Risks

Advertising, posting recorded courses, and running a coaching business online opens you up to some new risks. Cyberattacks and marketing mistakes like defamation, libel, and copyright infringement can land you in legal hot water.

A cybercriminal hacks a life coach’s phone and steals their client records. $200,000

A parenting coach is sued for using a photo they found online in their Instagram ad without permission. $200,000

Injuries & Property Damage

Life coaching isn’t usually physically demanding, but slips, falls, and other personal injury lawsuits are more common for small businesses than you might think. Repair and replacement claims for damage to rented offices or a client’s property can also add up.

A client trips over a cable at a group coaching session, hurting their knee. $74,950

A spiritual coach forgets they left incense burning in their rented office and starts a fire. $15,000

A life coach knocks over a client’s artwork during a home session. $33,584

9 Types of Life Coach Business Insurance

1. Professional Liability Insurance

What It Is:

Also called errors and omissions insurance, professional liability insurance covers anything you did (errors) or didn’t do (omissions) during your coaching that harmed someone else. At Insurance Canopy, life coach insurance pays up to $1 million per occurrence for professional liability claims.

What It Does:

If a client claims that taking your advice hurt their chances at a big promotion, your insurance is designed to keep you from getting stuck with the bill for lawyer fees, settlements, damages, or other court costs.

2. General Liability Insurance

What It Is:

If you rent a coaching space or make client house calls, general liability insurance is a must. This coverage covers your costs when someone gets physically hurt or their property gets damaged because of your coaching.

What It Does:

If a retirement coaching client slips going down your stairs or your water bottle leaves a ring on your client’s antique table, you could be in for an expensive claim. General liability keeps you from paying out of pocket.

3. Personal & Advertising Injury Coverage

What It Is:

Marketing is a must if you want clients, but it comes with risks. If you’re accused of wrongdoing like false advertising, invasion of privacy, libel, or slander, personal and advertising injury coverage protects your business finances.

What It Does:

Say a competitor accuses you of falsely reporting in your ads that they’re less qualified than you because they’re not a certified life coach. Personal and advertising injury coverage can help if they sue.

4. Products & Completed Operations Coverage

What It Is:

This coverage protects you from harm caused by your finished sessions or products you use to coach. Phrased another way, it’s coverage for when someone isn’t happy with their results.

What It Does:

If a client decides to sue you because they didn’t think your self-improvement system worked, products and complete operations insurance can guard you against those claims and legal fees.

5. Damage to Premises Rented to You Coverage

What It Is:

This coverage protects you from paying if there’s an accident that damages a space you rent.

What It Does:

This coverage is designed for temporary rentals, like booking a few hours in a community center for group coaching or renting a conference hall for a three-day seminar. However, it will cover any damage to spaces you rent for your business for the first seven (7) days in a row. After that, it only covers your biggest property risk: fire damage.

6. Medical Expense Limit

What It Is:

General liability covers physical injuries your business is legally responsible for, but what about when you’re not technically at fault? Insurance Canopy life coach coverage has a medical expense limit of $5,000 you can use to pay someone else’s medical bills related to your practice, whether the injury was your fault or theirs.

What It Does:

Say you’re in a situation where paying a client’s hospital bill might help you keep their business and avoid the headache of a lawsuit, even though the injury isn’t technically your fault. Your medical expense limit protects your reputation as a coach who cares by helping you make the situation right.

7. Cyber Liability Insurance

What It Is:

If you collect clients’ payment info, phone numbers, and other personal data, you are legally responsible for keeping it safe. Meanwhile, hackers are happy to use gaps in your security to steal from your accounts and devices. Cyber liability insurance is an optional coverage through Insurance Canopy that pays legal and data recovery costs if you get hacked.

What It Does:

Data breach lawsuits are often class action (meaning they come from multiple people), so they’re especially costly. Cyber liability insurance has your back to protect your finances if you get hacked and need to make it right for clients.

8. Equipment & Materials Coverage (Inland Marine)

What It Is:

Work-from-home coaches, did you know that most Homeowners Insurance wouldn’t pay for your business property if it was stolen or damaged during a break-in? Equipment & Materials Insurance is an optional coverage that pays you back for the damage or loss of business supplies.

What It Does:

If someone steals your presentation materials out of your car at a speaking gig or a client spills their coffee all over your laptop, Equipment & Materials coverage can pay for repairs or replacements.

9. Additional Insureds

What It Is:

This one isn’t technically a coverage, but it is an important part of coaching insurance. Additional insureds are people and companies you add to your insurance policy to be covered financially if you make a mistake that gets them named in a lawsuit. At Insurance Canopy, you can add as many as you want to your life coach policy for free.

What It Does:

The landlord of your coaching space or a company you contract with for speaking engagements might ask to be added to your policy as an additional insured. Adding them quickly and easily lets you make the most out of the opportunity instead of missing out.

How to Choose the Right Coverage for Me

Ready to comparison-shop life coaching insurance? Let’s speed up your research.

Not every policy called liability insurance for life coaches covers the same things. Answer the questions in this flow chart to decide which coverages you need to protect your unique practice.

Which Life Coach Insurance Do I Need?

Life coach insurance from Insurance Canopy lets you gather all of these coverages into one, simple policy that saves you time and money.

How Much Does Life Coaching Insurance Cost?

Life coach liability insurance costs as little as $21.08/month or $229/year with Insurance Canopy. Several factors go into your business’s price, so we created some tools to help you understand how insurance costs work and make the best decisions for your practice

Insurance Pricing Tools

- Life coach insurance cost breakdown: Learn about how your income, claim history, and optional coverages affect policy price before you buy.

- Insurance price comparison chart: See head-to-head comparisons of life coaching insurance prices and coverages from different companies.

4 Ways to Manage Life Coaching Risks

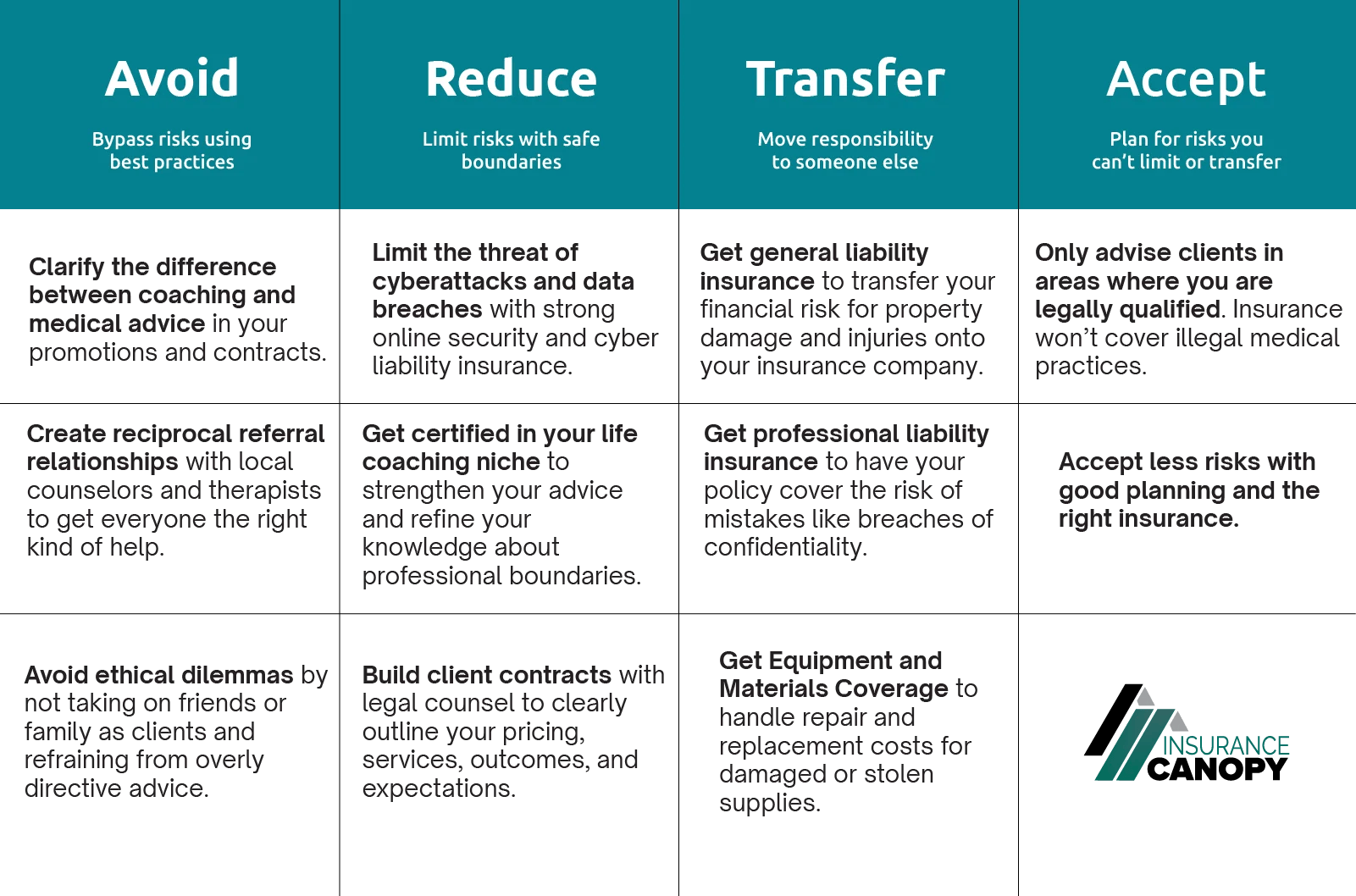

Getting insurance for your life coaching business isn’t the only way to strategize for success. There are four (4) major risk management methods to limit your liabilities as a life coach: avoid, reduce, transfer, and accept.

Protect Your Practice with Insurance Canopy

This is your year for covered and confident life coaching. Invest in a healthy, flourishing practice with Life Coach Insurance.

Life Coaching Insurance FAQs

Does insurance cover virtual coaching sessions?

Yes! Life coach insurance from Insurance Canopy includes several coverages to protect your online coaching:

- Professional Liability Insurance protects your online advice, including recorded and streaming sessions.

- Equipment & Materials Coverage can pay to repair or replace business equipment like your work laptop, streaming gear, or recording equipment if it’s stolen or damaged.

- Personal & Advertising Injury Insurance is designed to cover your digital marketing if a mistake leads to a lawsuit.

How does life coach insurance protect my business reputation?

There are two main ways your life coaching insurance protects your business reputation:

- It keeps you resilient: If a client decides to sue you, professional liability coverage pays legal costs to help your business bounce back quickly. This coverage limits cashflow shortages to keep your business running smoothly, no matter what.

- It proves that you’re a professional: Anyone can call themself a life coach, but not every coach has a trustworthy practice. Liability insurance builds your reputation by showing that you understand your risks and care enough about your clients to be prepared.

Do I need life coach insurance to get certified?

Credible certifiers recommend that coaches buy liability insurance for their practice, but insurance isn’t usually a requirement to get certified. Check with your certifying association for their specific rules.

How do I file a life coach insurance claim?

Filing a claim for your Insurance Canopy life coach policy is quick and easy.

- Log into your account and click “File a Claim” in your online dashboard.

- Answer the questions about your business and the details of the incident.

- Submit the claim.

That’s it! A licensed service rep will reach out within 24–48 hours to talk you through next steps.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.