Last Updated: 7/1/2025

Liquor liability coverage is an insurance policy designed to protect your business from the risks of selling, serving, and providing alcohol. This includes third-party property damage, bodily injury, and assault claims.

Understanding how liquor liability works — especially how it relates to dram shop laws and other alcohol regulations — is essential for any alcohol-serving business. Get answers to your questions about this coverage and discover how Insurance Canopy helps you manage your risk and safeguard your business!

What Does Liquor Liability Insurance Cover?

Liquor liability insurance can cover the costs related to third-party claims involving alcohol you served or sold to someone.

Here are just a few examples of alcohol-related claims you could face in your line of work:

- An intoxicated customer drives home and collides with another vehicle, resulting in serious injuries and damage to both vehicles.

- A wedding guest you served alcohol to becomes belligerent, punching a hole in the wall of the venue.

- Two estranged cousins get drunk at a family reunion and start a fistfight, with one of them sustaining serious injuries that require a trip to the hospital (requires assault and battery coverage).

If you are held responsible for the medical bills or property repair/replacement costs stemming from incidents like these, your liquor liability policy could cover some or all of these expenses. It can also cover attorney’s fees, settlements, or judgments you face while defending yourself in a lawsuit.

Are My Employees Covered Under My Liquor Liability Policy?

Yes! Your liquor liability policy extends to W2 employees and volunteers. That means if one of your employees served alcohol to someone who later caused an accident, your liquor liability policy could cover the medical bills, property repairs, and legal fees they have to pay as a result.

Does General Liability Insurance Cover Alcohol-Related Claims?

No, it does not. It’s a common misunderstanding that general liability policies cover alcohol-related claims, when in reality they specifically exclude claims stemming from selling, serving, distributing, or manufacturing alcoholic beverages.

That’s where liquor liability insurance comes in — it’s specifically meant to cover those exclusions so your business has a shield against the cost of alcohol-related claims.

However, you must have an active general liability policy to purchase liquor liability insurance. This general liability policy must have limits equal to or greater than the limits of your liquor liability policy.

For example, if your general liability policy has an aggregate limit of $1,000,000 and your liquor liability policy has an aggregate of $2,000,000, your liquor policy would be void. But if both limits were the same (or if your general liability has higher limits), you’d be set.

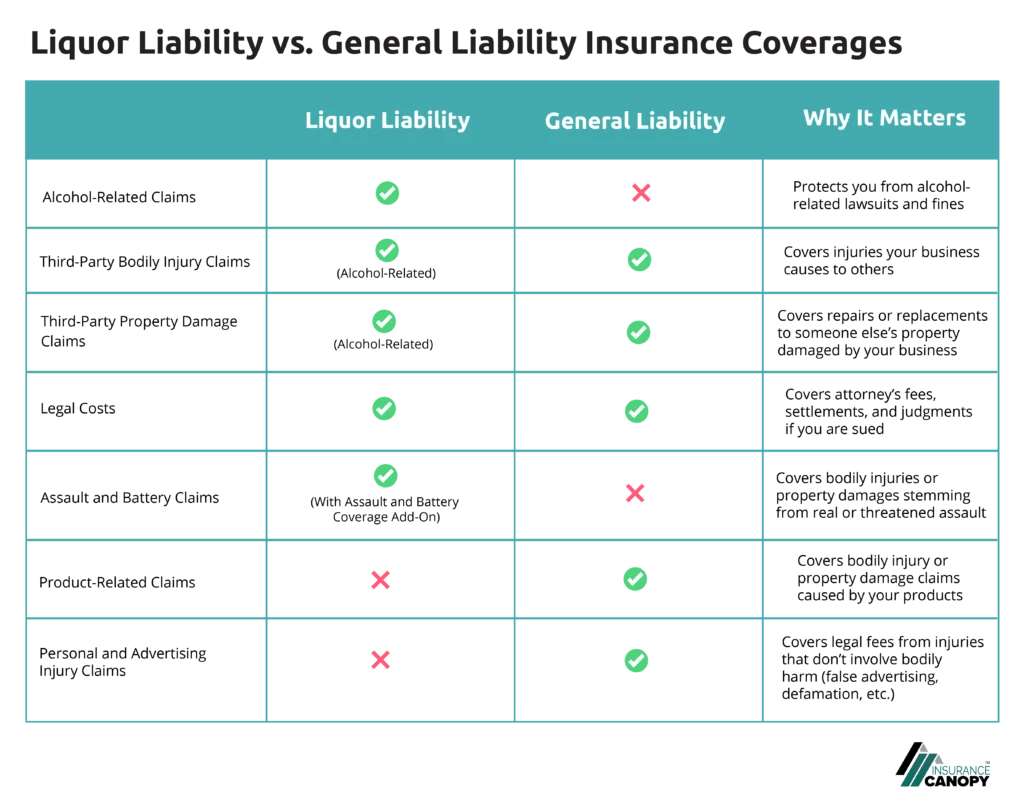

Let’s examine the coverage differences between these two liability policies to understand how they work together to protect your business from some of the biggest risks it faces.

Do I Need Liquor Liability Insurance?

To see if you need liquor liability insurance, answer each of these questions:

- Do you serve alcohol as part of your regular business operations?

- Are you a freelance bartender?

- Do you offer your clients complimentary alcoholic beverages?

- Do you sell alcoholic beverages…

- For consumption on premises?

- As a vendor at an event or venue?

- For consumption off premises?

- Do you regularly provide alcohol to clients, customers, or guests?

- Are you an alcoholic beverage manufacturer?

- Do you import alcoholic beverages?

- Do you distribute alcoholic beverages?

If you answered yes to any of these questions, you need a liquor liability policy.

The claims your business could face can be extremely expensive, with many costing you tens of thousands of dollars (or more). Most businesses cannot afford this expense, but liquor liability coverage can pay for these costs, allowing you to continue operations without a temporary or permanent shutdown.

How Do Dram Shop Laws Affect My Need for Liquor Liability Coverage?

42 states and the District of Columbia have dram shop laws, which hold businesses legally liable for injuries and damages caused by an intoxicated customer or minor they served alcohol to. Some of these states may require you to carry liquor liability insurance.

However, even if you live in a state without dram shop laws, you can still be sued over damages caused by your intoxicated patrons. A liquor liability policy can cover your legal expenses in this case, as well as any bodily injuries or property damage you’re found responsible for.

What Types of Businesses Need a Liquor Liability Policy?

Here are just a few examples of businesses that commonly need liquor liability coverage:

What Is Host Liquor Liability Insurance, and Can I Get It Instead?

Host liquor insurance is designed to protect anyone hosting a private event where alcohol will be served, sold, or provided, such as:

- Anniversaries

- BBQs

- Birthday parties

- Corporate parties

- Luncheons or dinners

- Retirement parties

- Weddings

There are a couple of differences between host liquor and liquor liability you need to be aware of:

- It is a short-term coverage option to shield hosts from alcohol-related claims that may happen at their event.

- Most importantly, host liquor is only for people whose normal business activities do not include alcohol. It is not a substitute for liquor liability insurance.

For example, ABC Toy Company plans to serve beer and wine at its annual company holiday party. They manufacture toys, and their business does not involve selling or serving alcohol, so they are a good fit for a host liquor policy.

On the other hand, the bartender ABC Toy Company hires to work the party needs a liquor liability policy. Not only are they not the host of the event, but they’re also in the business of selling and serving alcoholic beverages. For these reasons, host liquor insurance would not protect them from alcohol-related claims.

Pro Tip: If you need host liquor insurance, our trusted partner, The Event Helper, provides coverage starting at just $66 for a small event!

How Much Does Liquor Liability Insurance Cost?

Insurance Canopy offers an annual liquor liability policy starting at $35.42 a month, designed for businesses that sell, serve, or provide alcohol more than once per year.

Our annual policy also includes general liability insurance, so you’re protected from both alcohol-related and non-alcohol-related claims.

If you only need short-term insurance, we have an event liquor liability policy that starts at $275 for three consecutive days of coverage. This policy is best-suited for businesses that only serve alcoholic beverages at one event each year.

What Factors Affect My Cost?

The amount you pay for liquor liability coverage depends on:

- Your location: Each state has different regulations associated with selling alcohol. The price of your premium may go up if you live in a state with stricter dram shop laws.

- Your gross annual sales: Businesses with higher revenue tend to have more risk exposure, which can increase the cost of your premium.

- Your claims history: Having a history of claims can signal to insurance companies that you pose more of a risk than a business that has never filed a claim.

How Can I Keep My Liquor Liability Premium Low?

While some cost factors, like your location, are out of your control, there are several ways you can reduce your chance of a liquor liability claim and keep your premiums lower:

- Always check IDs when serving alcohol

- Make sure your staff take alcohol server training, such as TIPS or ServSafe Alcohol)

- Develop written policies around serving alcohol that you enforce with your staff

- Know the signs of intoxication and refuse service when necessary

- Pay upfront for the year on an annual policy, so you don’t have a monthly payment installment fee

- Educate yourself on the dram shop or liquor laws in your area, so you know what you can be held legally liable for

Keep Your Business Off the Rocks: Safeguard It With Insurance Canopy!

When it comes to protecting your business from claims and lawsuits, Insurance Canopy has your back with top-rated, affordable coverage.

If you don’t currently have general liability insurance, we make it easy to bundle this coverage with liquor liability during the checkout process. Our annual plan includes the following for well-rounded coverage from common claims:

- General liability

- Liquor liability

- Products and completed operations

- Personal and advertising injury

- Damage to premises rented to you

- Medical expenses

Plus, you can get your free quote online in 10 minutes or less, so you can get back to doing what you care about: running your business.

Don’t settle for less — get the best liquor liability insurance from Insurance Canopy!

FAQs About Liquor Liability Coverage From Insurance Canopy

Can I Get Insurance for My Bar, Restaurant, Cafe, or Tavern From Insurance Canopy?

No, Insurance Canopy’s liquor liability policy is designed for business owners who do not own a permanent brick-and-mortar retail space.

Can I Add Excess Liability Coverage to My Liquor Liability Policy?

Excess liability coverage is not available for our liquor liability policy — only for our general liability coverage.

The maximum limits for liquor liability are:

- $1,000,000 per occurrence (for each claim)

- $2,000,000 aggregate (for all claims within your policy period)

Does Liquor Liability Insurance Cover Independent Contractors?

No, Insurance Canopy’s policy does not cover independent contractors who have contracted with a restaurant, cafe, bakery, tavern, or similar establishment.

Disclaimer: Policies may be placed with different insurance companies. All insurance policies have specific coverages, limitations, exclusions, and conditions. Please refer to your policy and agent for exact coverages.