“Insurance sounds like a foreign language!”

Yeah, you bet it does. I’m just a marketing girl who happened to land a job in the insurance industry. I know it’s complicated and wordy. But if I can learn it, I know you can too!

The good news is: you don’t have to become an insurance expert to make smart, confident decisions for your business. Whether you’re shopping for your first policy or just want to understand what you’re already paying for, this guide’s got you covered.

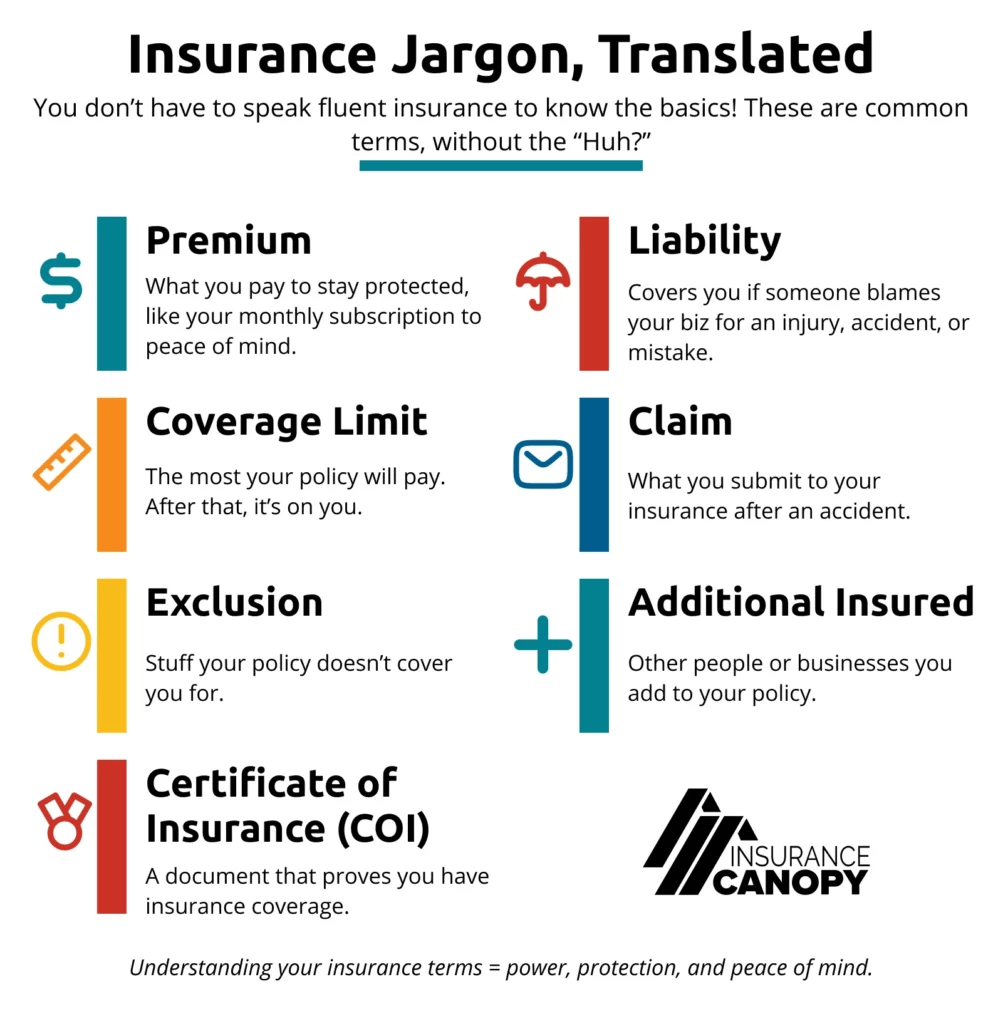

TL;DR: Small Biz Insurance Terms Made Simple

Premium = What you pay to stay covered

Deductible = What you pay out of pocket when you file a claim

Liability Insurance = Covers you if your business is blamed for harm

COI = Proof of insurance that clients may ask for

Understanding these terms helps you get the right protection, without overpaying!

Common Small Business Insurance Terms You Need To Know

Understanding your small business insurance doesn’t require a license or degree. Just a little curiosity, a few solid definitions, and the confidence to ask (or Google) questions.

Here are some of the most common insurance terms you’ll see, translated from “jargon” into “real human.”

Additional Insured

A person or organization added to your policy who also gets coverage under your plan.

How It Works: A wedding venue requires you to add them as an additional insured before you work an event on their property.

Claim

A formal request you make to your insurance company to help pay for something your policy covers, like damage, an accident, or a loss.

How It Works: If someone slips and falls on your property, you can file a claim to cover their medical costs.

Coverage Limit

The maximum amount your policy will pay for a covered claim.

How It Works: If your limit is $1 million per incident, your insurer won’t pay more than that for any single claim.

Deductible

The amount you must pay before your insurance kicks in after a claim.

How It Works: Let’s say your deductible is $500 and your claim is $2,000; you pay $500 and your insurer pays $1,500.

Endorsement (Rider)

An add-on to your insurance policy that expands or modifies your coverage.

How It Works: You add an endorsement called Excess Limits of Liability to increase your original coverage limits.

Exclusion

Something your insurance policy specifically does not cover.

How It Works: If your policy excludes flood damage and a storm floods your workspace, you’re on the hook for the repairs to your damaged equipment.

Liability

Coverage that helps if your business is blamed for causing harm to a person or their property.

How It Works: A customer trips over your power cord at a farmers market booth and breaks their wrist. Liability insurance helps cover their medical bills.

Premium

The cost of keeping your insurance policy active, like a subscription fee for protection.

How It Works: Let’s say you pay $300 annually to keep your general liability insurance active; that would be your annual premium, or the total cost of your policy.

Types of Insurance for Small Businesses: Liability, Workers Comp, and More

Not all businesses need the same insurance. It’s good to know the most common policies entrepreneurs use and what they actually do (so you know if you need them too).

Business Owner’s Policy (BOP)

A combo of general liability and property insurance, often bundled at a discount. Great for small businesses looking for solid, affordable coverage.

Commercial Property Insurance

Covers buildings and your physical stuff (tools, gear, or inventory) from fire, theft, or storm damage at your primary location.

Cyber Liability Insurance (Data Breach Coverage)

If you store customer data or accept online payments, this helps your business recover from data breaches and cyberattacks.

General Liability Insurance

Covers accidents like property damage or someone getting hurt on your premises. This is the most basic and most essential coverage.

Inland Marine Insurance (Tools and Equipment Coverage)

It has nothing to do with water, but everything to do with covering your movable gear and inventory while in transit or storage away from your primary location.

Product Liability Insurance

If you sell, make, or distribute products, this covers you if something you sold causes harm.

Professional Liability (Errors & Omissions)

Protects you if a client claims your advice or services caused them financial loss. Especially important for consultants, coaches, or service pros.

Workers Compensation

Most states require this if you have at least one employee (besides yourself). It helps cover medical bills and lost wages if an employee gets hurt on the job.

Understanding Premiums, Deductibles, and Coverage Limits

Think of insurance like ordering from a menu:

- Premium = the cost of your meal

- Deductible = the appetizer you have to order before the main course arrives

- Coverage Limit = the maximum amount the restaurant is willing to serve you

In real terms, your premium is what you pay for your policy. Deductibles are like a fee you pay when you file a claim before your policy can pay out its portion. The coverage limits are the total amount your policy will cover for a single claim and all the claims you file within your policy term.

Here’s some additional breakdowns to keep in mind:

- A lower premium usually means a higher deductible (you pay more out of pocket when something goes wrong)

- A higher coverage limit means more protection, but it might raise your premium

Make sure your limits actually match your risks. Underinsuring can cost you big time when you need help the most.

Pro Tip: Watch for “per occurrence” vs. “aggregate” limits:

- Per occurrence = max the policy pays for a single incident

- Aggregate = max it pays over the entire year

You Don’t Need To Speak Insurance To Be Protected

You built your business from the ground up — you can absolutely handle this! And now that you know the basics, you’re already miles ahead of where you were five minutes ago.

So take a breath, bookmark this page, and keep going. We’re cheering you on the whole way!

Feeling confident and ready for coverage? Get a custom quote today by selecting your industry below.

FAQs About Small Business Insurance Terms

Do I Need Liability Insurance if I Work From Home?

Yes, you need liability insurance if you work from home. Your homeowners or renters’ insurance likely won’t cover business-related claims. Liability insurance protects you if a client visits your home office and is hurt on your property or if your work causes them harm.

What’s a Certificate of Insurance (COI)?

A Certificate of Insurance (COI) is a document proving you have insurance. Clients and venues often ask for this before hiring you.

What if I Don’t Understand My Policy?

If you don’t understand your policy, please contact our customer support team at 844.520.6993 or info@insurancecanopy.com. Every agent is licensed and U.S.-based and here to help answer your questions!

What’s the Easiest Way to Compare Small Business Insurance Policies?

The easiest way to compare small business insurance policies is to get custom quotes from multiple providers. That way, you have various plans tailored to your specific business needs, and you know exactly what they offer.

When comparing policies, look at:

- Price/premium

- Coverage limits

- Optional add-ons

- Exclusions

- Ease of renewals

- Customer reviews

- Online resources available to you

The best policies are not always the cheapest. You’ll want to select one that is affordable, while also providing the right type of coverage, not too little or too high of limits, and a smooth customer experience.