- Last Updated:

- 5/1/2025

- Tricia Johnson

Let’s talk liability. If you’re reading up on private tutor insurance, you’re probably wondering:

- Do I actually need to spring for coverage?

- What are my risks as a private tutor?

- What kinds of insurance coverage do I need as a tutor?

- Where can I find affordable insurance for private tutors?

This crash course will cover all of those things, pronto. To put abstract insurance ideas into the real world, we’ll follow three tutors to learn how liability situations and having (or not having) insurance could play out.

This is Stella. She works as an independent contractor for a big online tutoring company, where she tutors college writing and ACT test prep. The company doesn’t provide her with private tutoring business insurance, but the company has her back if she gets sued…right?

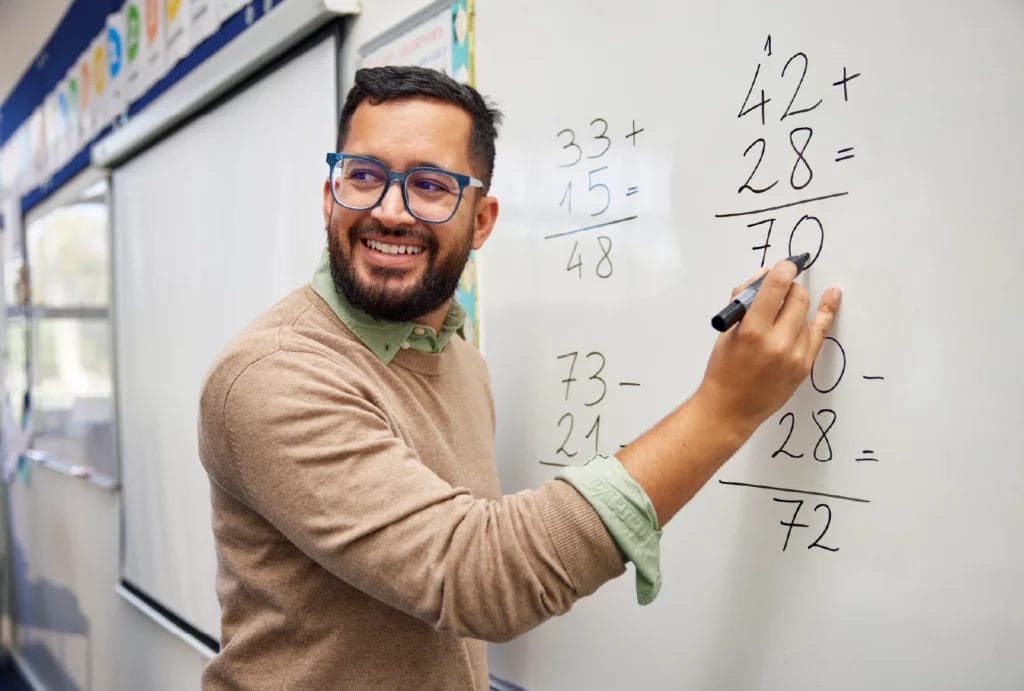

This is Juan. He’s a private math tutor who wants to be an afterschool vendor for a charter school. The school requires him to show proof of liability insurance and add them as an additional insured. He wonders whether the cost and work of getting all that set up is worth it.

This is Sid. He’s a middle school art teacher who gives freelance painting and pottery lessons as a summer side gig. He hosts students in his studio and makes home visits for tutoring, so he’s worried about kids getting injured or accidentally damaging a client’s stuff.

Do Private Tutors Need Insurance?

Teacher liability insurance is the smart choice for all private tutors to protect their finances against the risks of their job or side hustle.

Your liability risk (the chance of being financially responsible for harm to someone else) will be higher or lower depending on how and where you teach. However, any tutor who offers their expertise for pay could be stuck with a pricey claim if an accident, mistake, injury, or misunderstanding happens on their watch.

Common Private Tutor Risks & Liabilities

Let’s discuss the major legal risks for a private tutor to understand how your teaching environment and services affect your liabilities.

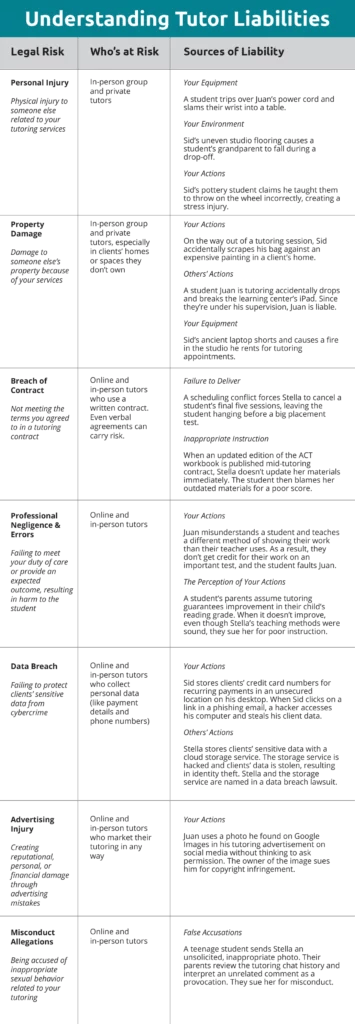

Understanding Tutor Liabilities

Legal Risk

Who’s at Risk

Sources of Liability

Personal Injury

Physical injury to someone else related to your tutoring services

In-person group and private tutors

Your Equipment

A student trips over Juan’s power cord and slams their wrist into a table.

Your Environment

Sid’s uneven studio flooring causes a student’s grandparent to fall during a drop-off.

Your Actions

Sid’s pottery student claims he taught them to throw on the wheel incorrectly, creating a stress injury.

Property Damage

Damage to someone else’s property because of your services

In-person group and private tutors, especially in clients’ homes or spaces they don’t own

Your Actions

On the way out of a tutoring session, Sid accidentally scrapes his bag against an expensive painting in a client’s home.

Others’ Actions

A student Juan is tutoring accidentally drops and breaks the learning center’s iPad. Since they’re under his supervision, Juan is liable.

Your Equipment

Sid’s ancient laptop shorts and causes a fire in the studio he rents for tutoring appointments.

Breach of Contract

Not meeting the terms you agreed to in a tutoring contract

Online and in-person tutors who use a written contract. Even verbal agreements can carry risk.

Failure to Deliver

A scheduling conflict forces Stella to cancel a student’s final five sessions, leaving the student hanging before a big placement test.

Inappropriate Instruction

When an updated edition of the ACT workbook is published mid-tutoring contract, Stella doesn’t update her materials immediately. The student then blames her outdated materials for a poor score.

Professional Negligence & Errors

Failing to meet your duty of care or provide an expected outcome, resulting in harm to the student

Online and in-person tutors

Your Actions

Juan misunderstands a student and teaches a different method of showing their work than their teacher uses. As a result, they don’t get credit for their work on an important test, and the student faults Juan.

The Perception of Your Actions

A student’s parents assume tutoring guarantees improvement in their child’s reading grade. When it doesn’t improve, even though Stella’s teaching methods were sound, they sue her for poor instruction.

Advertising Injury

Creating reputational, personal, or financial damage through advertising mistakes

Online and in-person tutors who market their tutoring in any way

Your Actions

Juan uses a photo he found on Google Images in his tutoring advertisement on social media without thinking to ask permission. The owner of the image sues him for copyright infringement.

Misconduct Allegations

Being accused of inappropriate sexual behavior related to your tutoring

Online and in-person tutors

False Accusations

A teenage student sends Stella an unsolicited, inappropriate photo. Their parents review the tutoring chat history and interpret an unrelated comment as a provocation. They sue her for misconduct.

Tutor Lawsuits & Claims Examples

How much might a claim against a private tutor or tutoring business cost? Tutor legal claims can range from inconvenient to the bleeding edge of bankruptcy. Let’s look at a few examples.

Sid scratches his student’s hardwood floor during an in-home visit. The student’s parents want him to pay the repair bill.

Estimated Cost: $500 to $1,000*

Stella uses an online platform to store her student records and invoices. When her account is hacked, sensitive data is exposed in the breach, and multiple students sue. Stella is an independent contractor, so the tutoring company she works for doesn’t cover any of it.

Estimated Cost: $25,000 to $100,000*

The cost of a data breach lawsuit like this varies depending on the number of clients affected and the extent of the breach.

*All claim amounts in this article are estimates based on internal knowledge and research. Every insurance policy has conditions, limitations, and exclusions, so read your policy carefully to ensure you understand what’s covered.

Real Tutor Lawsuits in the News

Consider this 2024 San Jose tutoring negligence case, in which a seven-year-old wandered out of a locally owned learning center franchise after a checkout desk misunderstanding and was injured by a passing car.

Should it happen? Never. But can you imagine how the circumstances might have fallen into place that allowed it?

Here’s the bottom line: Some tutors go their whole career without an issue, while others have their finances and reputation derailed by a single claim. Educational lawsuits are on the rise in general, and it pays to know your legal risks and have private tutor insurance as a safety net.

How a Claim Plays Out With and Without Insurance

Not sure how claims (or lawsuits) work? If your covered claim goes to court, private tutoring business insurance is with you every step of the way. Let’s follow two tutors — Zoe, insured through Insurance Canopy, and Brock, who doesn’t have insurance — to see the difference coverage makes.

Insured: Zoe

Uninsured: Brock

Zoe is a medical education consultant who sometimes tutors MCAT test prep online for a well-known tutoring website.

Brock is an adjunct English instructor who tutors GRE test prep online during the summer as a side gig.

Breach of Contract

Zoe and Brock both have a death in the family and have to fly out to help with arrangements. There’s a lot to handle, so they cancel their contract’s final five tutoring sessions directly before their student takes a critical, expensive, graduate-level test. It’s terrible timing, but what else can they do?

Both students get a last-minute replacement tutor and take the test. Neither gets the score they need.

Notification of Claim

Zoe and Brock each receive a formal legal notice from the student claiming that they breached their contract and they’re being sued.

Zoe notifies her insurance company, which guides her through next steps.

They review her claim, ensure it’s covered, assign a claims adjuster, and help her decide what documentation she needs. She’s organized, supported, and ready to take her case to a lawyer.

Brock has a little freakout, then Googles what to do next.

He posts in a forum and gets widely different advice. He’s not sure what paperwork he needs, so he guesses. He needs a lawyer, but he’s not sure who’s best for his case, so he also guesses.

Legal Assistance

They each need legal counsel to help build their cases and represent them in further interactions with the students.

Zoe’s tutor insurance appoints a lawyer to represent her.

Insurance provides her defense and covers some or all of the lawyer fees. Her legal counsel works with her to gather evidence and prepare a defense, including documentation of the family emergency.

✅ Representation cost: $150 – $500/hour

This claim falls under Zoe’s professional liability limit. She has Tutor Insurance that covers up to $1 million per occurrence.

✅ Total representation cost to Zoe: $0

Brock finds and hires a lawyer.

Brock needs to get his own representation and pay his lawyer fees. Once he’s chosen a lawyer, they prepare a defense and gather the paperwork.

❌ Representation cost: $150 – $500/hour

Let’s assume this is a moderately contested case that goes to court and lasts about 40-60 hours.

❌ Total representation cost to Brock: $6,000 – $30,000

Settlement Negotiation

Their lawyers try to negotiate a settlement with the student to avoid the uncertainty and extra costs of taking the case to court.

Settlement costs might include reimbursement for the replacement tutor and other consequential losses the student claims.

If Zoe’s lawyer negotiates a settlement, great! Her tutor insurance will help cover the settlement amount up to the limits of her policy.

✅ Settlement cost to Zoe: $0

If Brock’s lawyer negotiates a settlement, that’s great! But Brock still has to pay the full settlement amount.

❌ Settlement cost to Brock: $5,000 – $20,000

Litigation

Their lawyers couldn’t settle with the students’ lawyers, so their cases go to court. Awards (payments) or damages (financial penalties) might include last-minute tutor costs, the test fee, and lost time and money for graduate program placements the students won’t qualify for. They might even have to pay for the student’s legal costs.

Zoe’s insurance-appointed lawyer represents her, and her insurance covers court fees (like filing and admin expenses), lawyer costs, and damages up to her policy limits.

✅ Court fee cost to Zoe: $0

✅ Awards cost to Zoe: $0

Brock’s lawyer represents him in court. He is responsible for paying any court fees, additional representation costs, or damages.

❌ Court fee cost to Brock: $500 – $2,000

❌ Awards cost to Brock: $5,000 – $20,000

Resolution

The case is resolved, either through a settlement or court ruling. Either insurance or the tutor pays up.

Zoe’s tutor insurance helps minimize her out-of-pocket costs.

✅ Representation: Covered

✅ Settlement or awards: Covered

✅ Court fees: Covered

✅ Total Zoe pays: $229/year for a Tutor Insurance policy

Brock’s on his own to deal with some significant legal costs.

❌ Representation: $6,000 – $30,000

❌ Settlement or awards: $5,000 – $20,000

❌ Court fees: $500 – $2,000

❌ Total Brock pays: $11,500 – $52,000

Note: This scenario does not guarantee coverage. Every insurance policy has exclusions and limits. Check your policy language and talk with your insurance company to learn exactly what’s covered or how you and your insurance would split costs.

Learn the Types of Insurance Coverage Tutors Need

Answering the question of whether tutors need insurance is easy — it’s almost always a yes. The bigger question is, “what insurance do I need as a private tutor?”

Specific types of insurance are designed to cover different risks, so private tutors looking for protection from every angle should choose a policy that combines their most important coverages. Here are the nine types of insurance private tutors need to cover their unique risks.

1. General Liability Insurance

General liability coverage is a broad protection that responds to bodily injury and property damage claims from other people because of your tutoring. Accidents happen to even the most careful and professional tutors. General liability takes the financial sting out of “oops” moments like spilling coffee on a student’s laptop.

General Liability in Action

Remember when Sid accidentally scratched the floor in his client’s home, or when Juan’s student tripped over his laptop cord and hurt himself? These types of medical and damage claims could be covered by general liability insurance.

2. Professional Liability Insurance

Also called errors & omissions insurance, professional liability covers your instruction. This includes things you did (errors) or didn’t do (omissions) that harmed someone else, like mistakenly teaching outdated information or forgetting to include an essential topic.

Professional Liability in Action

In our earlier tutor examples, Juan mistakenly taught a student the wrong method of showing their work — this could fall under professional liability. So could the parent who sued Stella for their child’s grade not improving. Professional liability might also protect against contract issues, like Stella or Zoe canceling sessions.

3. Products-Completed Operations

Products-Completed Operations insures against exactly what it says: harm caused to others because of products you use to tutor or your finished sessions.

Products-Completed Operations in Action

Remember the pottery student who claimed Sid’s technique caused an injury? Even if someone comes back after your tutoring relationship is over and claims your sessions harmed them or didn’t deliver as promised, Products-Completed Operations is there to protect you.

4. Cyber Liability Coverage

Cyber liability is a big deal for tutors who manage online student payments and records. This coverage (optional through Insurance Canopy) is designed to help tutors pay for data breach lawsuits and costs when a hacker steals clients’ sensitive information from you.

Cyber Liability Coverage in Action

When Stella’s invoices containing client personal data were stolen, her employer wouldn’t protect her financially. However, the cyber liability coverage she added to her own private tutor insurance could step in to help with legal costs and representation.

5. Damage to Premises Rented to You

Damage to Premises Rented to You is made to protect you from paying for property damage to spaces you rent for your business. It will cover any damage to your rental for the first seven (7) days in a row. After that, it will only cover your biggest property rental risk: fire damage.

Damage to Premises Rented to You in Action

Remember the fire Sid’s ancient laptop caused in his studio? Regardless of how long he had the rental, Sid’s Damage to Premises Rented to You insurance could help him cover the cost of building repairs.

6. Personal and Advertising Injury

Tutors constantly promote their services to find new students, which is why Personal and Advertising Injury is an essential part of insurance for private tutors. This coverage protects against accusations of wrongdoing in your marketing, like false advertising, invasion of privacy, libel, or slander.

Personal and Advertising Injury in Action

In a previous claim example, Juan used an image he didn’t own or create in his social media ad without thinking and got hit with a copyright infringement lawsuit. Personal and Advertising Injury could step in to cover the (typically pretty pricey) copyright lawsuit costs.

7. Equipment and Materials Coverage

Tutors often invest in laptops, tablets, workbooks, and other materials. When your own gear is damaged or stolen, the loss hits twice as hard. Not only are you out the money, but you can’t work until you replace it. Equipment and Materials Insurance (aka Inland Marine) is an optional coverage through Insurance Canopy that can reimburse you for repairs or replacements.

Equipment and Materials Coverage in Action

Imagine that Juan’s student didn’t drop the learning center’s iPad after all — it was Juan’s work tablet. That cracked screen hurts even more now. Equipment and Materials Coverage could help Juan pay to repair or replace the broken iPad.

8. Sexual Abuse & Molestation (SAM) Liability Insurance

Education is currently the industry with the third-highest instance of workplace misconduct allegations. No one wants to imagine a student would make a false accusation, but private tutors should consider Insurance Canopy’s optional SAM Liability Insurance to protect themselves from even the perception of misconduct.

SAM Liability Insurance in Action

Remember Stella’s uncomfortable situation with her teenage student? Even though she did nothing wrong, the incident could quickly turn into a misconduct lawsuit that would end her career. At a time when the last thing you want to think about is how you’ll pay legal fees, insurance can keep fighting a false allegation from draining your bank account.

Note: SAM Liability does not cover crimes. The goal of this coverage is to allow responsible and professional tutors like you to teach without fear that a misunderstanding could lead to a financially devastating lawsuit.

9. Additional Insureds

This isn’t technically coverage, but it is a vital part of insurance for private tutors. Additional insureds are people or organizations who request to be added to your insurance policy for coverage if they’re named in a lawsuit against you.

Additional Insureds in Action

When Juan applied to be a tutoring vendor at a charter school, the school asked him to add them to his policy as an additional insured. He wasn’t sure what that meant, or if figuring it out was worth the hassle. The good news is that he could add unlimited additional insureds to his Private Tutor Insurance policy with Insurance Canopy for free online.

How Tutor Insurance Benefits You

Private tutor insurance has several key benefits whether you’re a learning center owner or a freelance instructor.

1. It Shows You’re a Serious, Professional Educator

Having insurance tells potential students, clients, and employers like tutoring companies or schools that you’re prepared and informed. You understand the risks in education, and you’re ready for whatever your next session brings.

2. It Can Help You Get a Gig or Rent a Space

If you plan to work with a private school or learning center as an afterschool vendor, they may ask you to provide proof of insurance. They might also request that you add them to your policy as an additional insured (which protects your employer if they get sued for something you did.) If you already have insurance, you’re ready to go.

Likewise, suppose you’re a tutoring business looking to rent space to host students or start a learning center. The building manager will usually ask you to provide proof of insurance. One of the benefits of tutor insurance is that you don’t miss out on opportunities, and you’re not limited in where or how you can tutor.

3. It Gives You Peace of Mind

From accidentally damaging a client’s property to a negligence or misconduct lawsuit, education can be a risky job. You deserve the opportunity to tutor confidently instead of worrying about the what-ifs. Insurance gives you the peace of mind that if something goes wrong, you have financial support and expertise to help you through it.

4. It Can Shield You Against Expensive Claims and Lawsuits

From accidentally damaging a client’s property to a negligence or misconduct lawsuit, education can be a risky job. You deserve the opportunity to tutor confidently instead of worrying about the what-ifs. Insurance gives you the peace of mind that if something goes wrong, you have financial support and expertise to help you through it.

How to Get Covered with Insurance Canopy

At Insurance Canopy, you get affordable coverage for the protections tutors need — no more, no less. We offer Tutor Insurance starting at just $21.08/month. Customize your policy online to fit your unique needs and budget, get your instant certificate of insurance, and get back to teaching worry-free.

Get covered today, or keep growing your knowledge by learning how to start an at-home tutoring business.

Private Tutor Insurance FAQs

Do tutors need insurance?

Yes, all tutors should carry their own insurance, even if your school or employer doesn’t require it. Tutors frequently face claims based on mistakes, misunderstandings, and things that aren’t their fault. Even accusations that won’t win in court may require you to hire a lawyer and cost you time away from work. Insurance can keep you from footing the bill.

If I work for a tutoring company, do I need my own insurance?

Check your company policy, but in many cases, tutors who work for large tutoring corporations or franchises are still encouraged to buy their own private tutor liability insurance. Full-time employees might have limited coverage under the company’s policy, but independent contractors are typically on their own for liability insurance.

I tutor online — do I still need insurance?

Yes, online private tutors need insurance! While they won’t get injury or property damage claims, tutors who use an online platform or work for a tutoring website still need to protect their advice, client data, and marketing activities. Online tutors should look for insurance that offers professional liability, cyber liability, and personal and advertising injury.

How much does private tutor insurance cost?

Online and in-person tutors can get coverage from Insurance Canopy for just $21.08/month or $229/year. Flexible payment plans mean you can choose an annual payment and save or break your policy into monthly installments — whichever fits your budget best! Find out more about what determines your price in our tutor insurance cost guide.