- Last Updated:

- 10/18/2024

- Julis Navarro

AMRAP, EMOM, PB — your vocabulary is rich with fitness-specific terms you use to help clients achieve their goals. But now that you’re looking into getting covered as a personal trainer and hearing lingo like “general” and “professional liability” perhaps for the first time, it’s understandable if you feel a bit like an insurance-speak newbie.

What’s the difference? Do you need both?

The main difference between general and professional liability insurance is the scope of risks they cover — more on this in a bit. And yes, you need both!

But first, who is a personal trainer?

For our purposes, a personal trainer is any professional who provides fitness instruction and advice, including CrossFit trainers and instructors of yoga, dance, Pilates, Zumba, spin, gymnastics, or other training styles.

What Insurance Do Personal Trainers Need?

Personal trainer insurance requirements typically include general and professional liability insurance.

Just like you never skip the warm-up and always listen to your body, personal trainer insurance, also known as personal trainer public liability insurance, is essential to keeping your business healthy.

The two main types of insurance you need are general liability insurance and professional liability insurance.

- General liability insurance: coverage for third-party claims of bodily injury or property damage that come about just from you running your business.

- Professional liability insurance: coverage for the professional services you provide — aka your fitness instruction — in case they cause harm (or perceived harm) to a third party.

These coverages are heavy hitters that protect your business from the most common claims you face as a fitness pro.

When accidents happen, personal trainer insurance is what keeps you from having to pay out of pocket to make things right. Lawsuits, medical bills, settlement fees — these numbers can add up quickly and can break a small business.

If you want to keep training clients for a long time to come, getting insured is non-negotiable.

General Liability Insurance for Personal Trainers

General liability insurance covers you for accidents, such as clients getting hurt or having their things damaged, that happen as a result of your business operations.

General liability insurance is like a blanket of protection for your overall business. The key word here is “general” — so think of all the things that can go wrong just by you offering your next training session.

Now subtract the what-ifs that are specific to your fitness instruction and advice. (These fall under professional liability!)

General liability insurance is designed to cover things like slip-and-fall injuries, client injuries due to faulty equipment, or damage to the space you teach out of.

Examples of Personal Trainer General Liability Claims

- You’re running a group Pilates class, and one of your students spills their sports drink all over the floor. Before anyone can clean up the mess, another student slips on the puddle and breaks their wrist when they fall. The injured student decides to sue you because their injury happened while attending your class.

- You’re leading an outdoor boot camp class, when one of your more enthusiastic clients accidentally knocks over expensive park equipment, causing damage. The park authorities hold you responsible for the repair costs.

- You’re coaching a CrossFit WOD, when an athlete loses grip of a kettlebell, causing it to land on and destroy another athlete’s expensive new iPhone. The owner of the now-smashed smartphone insists you pay for a replacement.

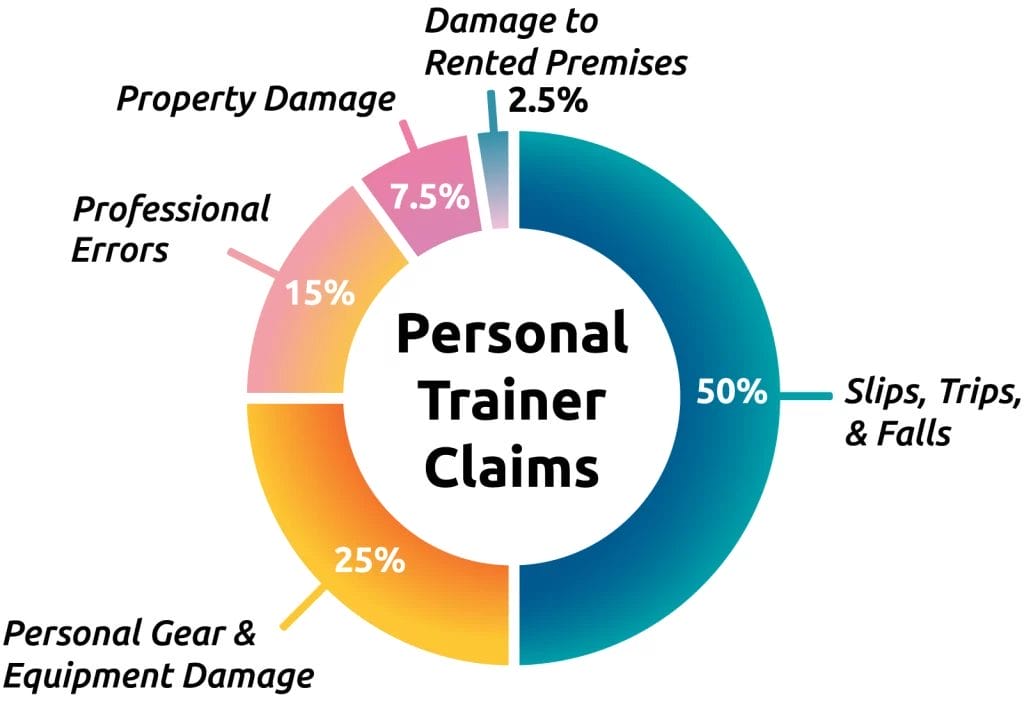

You do your best to keep everyone safe, but these accidents happen when you least expect. According to our 2024 personal trainer claims statistics, about half of personal trainer insurance claims are for slip-and-falls.

General liability insurance for personal trainers is even more essential to your business than a good workout playlist.

*Based on Insurance Canopy claims data from 2020-2024.

Professional Liability Insurance for Personal Trainers

Professional liability insurance covers you for claims related to your fitness expertise, such as negligence, advice that causes client harm, or unmet expectations.

While general liability insurance is more general in scope, professional liability insurance hones in on what you offer professionally — your fitness instruction and advice. This coverage is a little more abstract and can cover physical and non-physical damages.

If you’re negligent as a trainer or even if you’re perceived to be negligent, professional liability insurance can protect you both financially and reputation-wise.

Negligence is failure to exercise the care that a reasonable person would in like circumstances.

How can you be negligent? By having a client:

- Perform the wrong exercises

- Incorrectly perform the exercises

- Lift too much weight

- Use poor exercise form

- Use defective equipment

Everyone’s body is different; it can be difficult to gauge someone’s strength, endurance, or tolerance to discomfort and pain. Even with your best intentions and years of experience, you can simply make a bad call, leading to client injury.

When that happens, professional liability insurance for personal trainers keeps you from having to put your clients — and your entire business! — on hold.

Examples of Personal Trainer Professional Liability Claims

- You create a personalized workout plan for a client, but during a high-intensity session, they injure their back, putting them out of work. They say you gave them improper guidance and sue you for negligence.

- A client hires you to help them achieve their “dream body” for their wedding. Despite their efforts, they don’t hit their goal and accuse you of providing ineffective fitness training. They decide to take legal action against you for failing to deliver.

- You teach yoga online and always offer modifications for the more advanced asanas. However, a beginner student decides to go for a handstand inversion and falls out, causing persistent neck pain. They claim your instruction was unclear and sue your practice.

What is the difference between general liability and professional liability insurance?

The main difference is that general liability covers occurrences that arise from you operating your business. Professional liability insurance is more focused and specifically covers your professional services as a personal trainer.

How Much Is Liability Insurance for Personal Trainers?

Though some insurance companies do charge upwards of $500 a year for a policy, Insurance Canopy offers personal trainer insurance starting at just $15 a month (or pay just $159 per year with annual prepayment).

For less than the price of your protein powder jar a month, you can get excellent-rated coverage that doesn’t break the bank.

Insurance Canopy uncomplicates personal trainer insurance by combining general and professional liability coverage into one easy policy. You get all the essential coverage for your business operations and your professional services so you can train with full confidence.

Then, if you want to level up your policy, you can add optional coverages depending on your business needs.

- Additional insureds ($15/per or $30/unlimited): Do you work at a gym or fitness center? The facility might ask you to list them as an additional insured — this extends your coverage to them in case you both get named in a lawsuit.

- Cyber liability insurance ($8.25-$12.50/month): Do you store client info (like credit cards or addresses) or book clients online? This coverage is designed to protect you in case of cyber attacks.

- Gear and equipment coverage (from $1.33/month): Is your fitness gear crucial to running your business? This coverage — multiple tiers available! — can pay to repair or replace your movable business property in case of theft or damage.

- Diet and nutrition coverage ($6.83/month): Do you offer diet advice or meal plans to clients? This coverage includes these offerings under your scope of professional services, so you’re covered if your advice or meal plans end up harming a client.

- Sexual Abuse & Molestation (SAM) Insurance ($10.33-$14.46/month): This coverage is designed to help pay for claims related to sexual molestation or misconduct, like a misinterpreted touch or instruction.

How much is personal trainer insurance?

Starting at $15 a month with Insurance Canopy, personal trainer insurance is much cheaper than a lawsuit.

Check out these real-world examples of how much accidents can cost you.

- A NY woman injured after using a 50-pound weight vest on a stair climber during a personal training session: $2.25 million settlement

- Another NY woman fractured both wrists after getting caught on equipment, claiming her trainer was negligent: $300,000 settlement

- A UK violinist suffered injuries and long-term nerve damage when a machine collapsed on her at a celebrity trainer-founded Pilates studio: £250,000 settlement

What to Look for When Comparing Insurance Companies

Searching for the right insurance company is kind of like searching for a reliable workout partner — lots of factors to consider, and you need to know they’ll be there for you when the weight’s too heavy.

Be sure your insurance company checks all of these boxes.

Modalities Covered

First off, make sure your fitness specialty is covered by the insurance company’s personal trainer policy. You may even teach multiple fitness modalities, so check their list of what’s covered and confirm that none of your teaching styles are excluded.

Insurance Canopy’s personal trainer insurance policy covers over 100 popular fitness styles, so however you get clients moving, you’re likely covered!

Pricing

Next, is the policy’s cost within your budget? If you’re just starting out as a personal trainer or if you’re simply not a fan of paying more than you need to, it’s smart to research how much other insurance companies charge.

Personal trainer insurance typically costs from $200 to $500+ per year. Insurance Canopy’s policy starts at $159 a year, making it one of the most affordable options on the market today.

Coverage Limits

Coverage limits, or liability limits, are how much the insurance company will pay out when you need to file a claim. There are two types of coverage limits: per occurrence, how much insurance will pay for a single claim, and aggregate, how much insurance will pay out over an entire policy year (say you have multiple claims in a year).

The industry preference for personal trainer coverage limits is $2 million per occurrence and $3 million aggregate.

These may seem like big — perhaps unreachable — numbers, but remember the example lawsuits mentioned above? Medical expenses, legal defense, and settlement fees add up quickly.

Insurance Canopy’s coverage limits are $2M per occurrence and $3M aggregate. Our carrier is rated “excellent,” which means you can be confident in the financial strength of our coverage.

Customization

Make sure your personal trainer policy works for you and that you’re not paying for coverages you don’t need. As we mentioned earlier, Insurance Canopy’s personal trainer policy includes general and professional liability coverage, with options for add-ons like additional insureds or gear and equipment coverage.

You can customize your coverage when you first purchase your policy, or any time after through a convenient online dashboard — quicker than you can say “Engage your core!” (er, almost).

Customer Support

Just like you support your clients on their fitness journeys, you’re going to want an insurance company that won’t leave you hanging. Check customer reviews, particularly for how responsive each insurance company’s customer service is.

Insurance Canopy’s support team is made up of licensed agents, who don’t work on commission, so you know they’re not there to upsell, just to help get you insured.

Discover your state’s liability insurance requirements.

Extra Factors

Some other factors to consider when comparing personal trainer insurance include:

- Are there options to pay annually and monthly?

- Is the coverage mobile (i.e. does it follow you wherever you work)?

- Can you buy online and get instantly covered?

- Do you have 24/7 access to your certificate of insurance (COI)?

- Does your policy cover multiple fitness styles?

If you’re considering Insurance Canopy to cover your fitness business, the answer is “yes” to all the above!

FAQs About General and Professional Liability Insurance for Personal Trainers

Short answer: You need both general and professional liability insurance to protect you from multiple angles.

These two coverages work together, like a warm-up and a cool-down, to keep your business safe when things go wrong due to your business operations (general liability) and your fitness instruction, specifically (professional liability).

General liability insurance from Insurance Canopy also includes:

- Personal and advertising injury coverage, for non-physical damages, like libel, slander, or advertising mistakes.

- Products and completed operations coverage, for the products you use during sessions and your completed services (i.e., a completed training session).

- Damage to premises rented coverage, in case you or your clients accidentally damage your rented space, such as a fitness studio.

- Medical expense limit, to pay for third-party medical expenses, whether or not you’re at fault.

Julis Navarro | Copywriter

Seattle-based copywriter Julis Navarro leverages her love for yoga, dance, and wellness and holds a bachelor’s degree in journalism from Pepperdine University. Before working at Veracity, she wrote product and editorial copy, ranging from big-brand athleticwear descriptions to health and fitness curations, for online retailer Zulily. Fully trained on Insurance Canopy’s personal trainer coverage, Julis now writes to help match fitness professionals with their perfect insurance policies.

Seattle-based copywriter Julis Navarro leverages her love for yoga, dance, and wellness and holds a bachelor’s degree in journalism from Pepperdine University. Before working at Veracity, she wrote product and editorial copy, ranging from big-brand athleticwear descriptions to health and fitness curations, for online retailer Zulily. Fully trained on Insurance Canopy’s personal trainer coverage, Julis now writes to help match fitness professionals with their perfect insurance policies.